What is a prenuptial agreement in Florida?

A prenuptial agreement, commonly known as a prenup, is a legal document that couples sign before marriage. In Florida, this agreement outlines the division of assets and debts in the event of divorce or separation. It can also address spousal support and protect personal assets acquired before marriage. A well-drafted prenup can provide clarity and security for both parties.

Why should couples consider a prenuptial agreement?

Couples might consider a prenup to protect individual assets, especially if one or both partners have significant wealth, business interests, or children from a previous relationship. A prenup can help ensure that assets remain separate and are distributed according to the couple's wishes rather than state law. It promotes open communication about finances and expectations, creating a stronger foundation for the marriage.

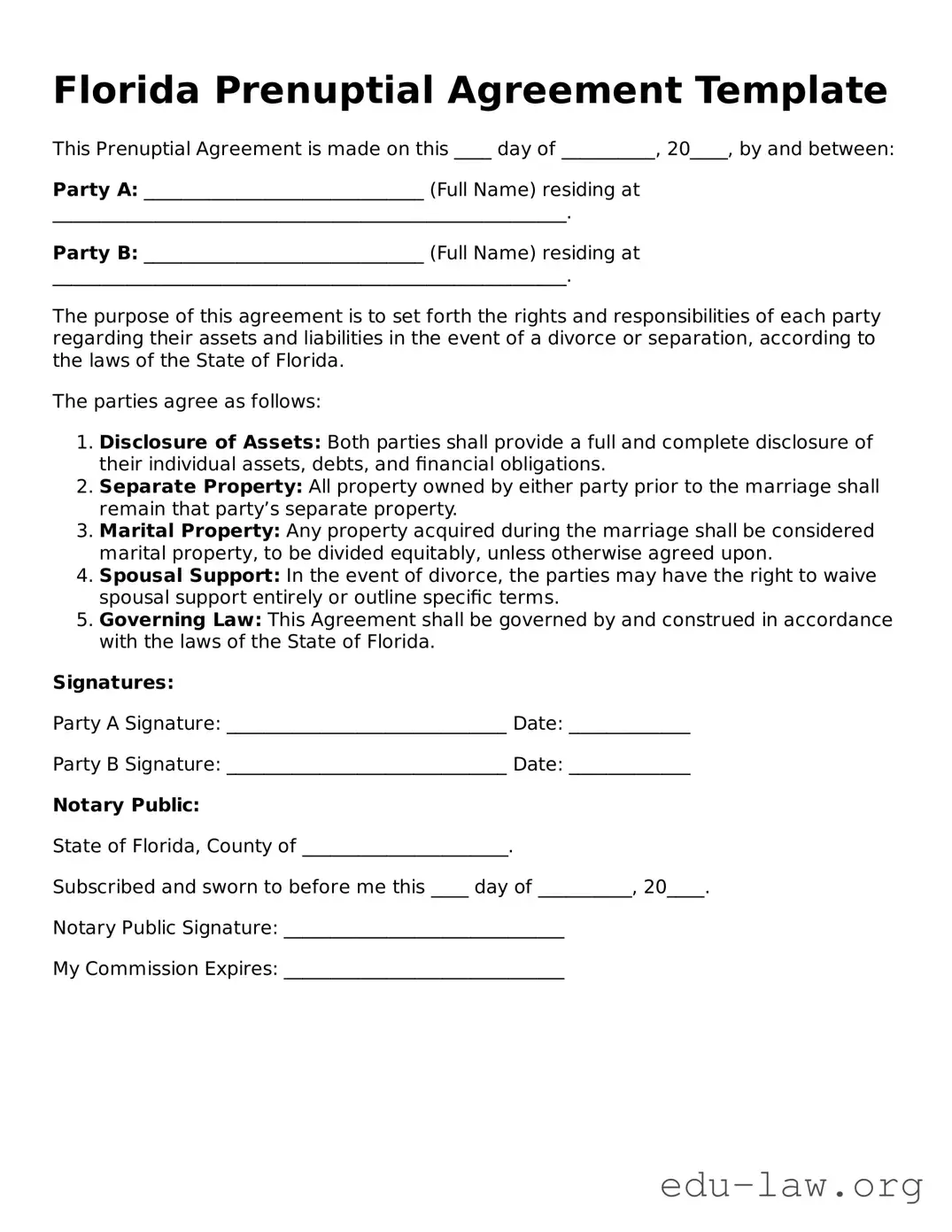

What are the legal requirements for a prenuptial agreement in Florida?

In Florida, a prenuptial agreement must be in writing and signed by both parties. Additionally, it cannot be unconscionable, meaning it should not favor one spouse excessively over the other. Full disclosure of assets and liabilities is essential; both parties should understand the financial situation before signing. If these conditions are met, the agreement is generally enforceable in court.

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified after marriage. However, for any changes to be valid, both parties must agree to them in writing. It is advisable to consult with an attorney when making amendments to ensure that the revised agreement meets legal standards and reflects the couple's current needs and circumstances.

What happens if one spouse does not follow the prenuptial agreement?

If one spouse fails to adhere to the terms of the prenuptial agreement, the affected spouse may seek enforcement of the agreement in court. The court will review the validity of the prenup and the specific circumstances surrounding the breach. If the agreement is found to be valid and enforceable, the court may compel compliance and determine any associated consequences.

Are prenuptial agreements only for wealthy couples?

No, prenuptial agreements are not exclusive to wealthy couples. Individuals of all financial backgrounds can benefit from establishing a prenup. It serves as a protective measure for personal assets, clarifies expectations regarding financial issues, and can simplify legal proceedings in the event of a divorce, making it a useful tool for anyone entering marriage.

How can one ensure the prenuptial agreement is enforceable?

To ensure that a prenuptial agreement is enforceable, couples should follow several guidelines. First, they should seek independent legal counsel to avoid any appearance of coercion or conflict of interest. Both parties should fully disclose their assets and debts to each other. Finally, the agreement should be fair, equitable, and free from duress or fraud, as these factors significantly impact enforceability in court.