What is a Florida Power of Attorney form?

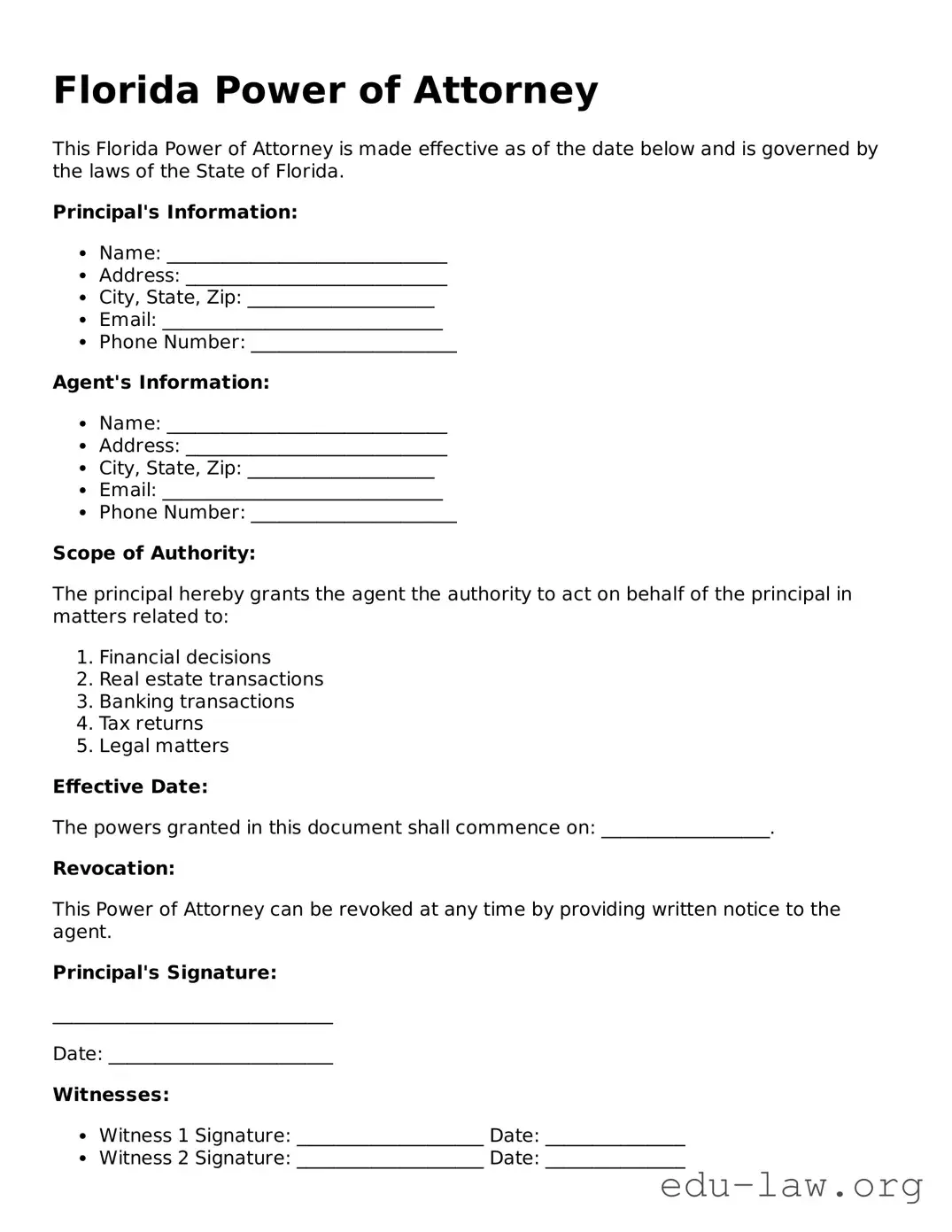

A Florida Power of Attorney form is a legal document that allows an individual, known as the principal, to designate another person, called an agent or attorney-in-fact, to act on their behalf in financial and legal matters. This document empowers the agent to make decisions and take actions as specified by the principal.

Why would someone need a Power of Attorney in Florida?

Individuals typically use a Power of Attorney to ensure that their financial affairs can be managed if they become incapacitated or unavailable to make decisions. This can include handling bills, managing investments, or dealing with other important financial responsibilities. It provides peace of mind and continuity in managing one's affairs.

What types of Power of Attorney are available in Florida?

In Florida, there are several types of Power of Attorney forms. The most common include:

1. Durable Power of Attorney: Remains effective even if the principal becomes incapacitated.

2. Springing Power of Attorney: Only comes into effect under certain conditions, typically when the principal is incapacitated.

3. Limited Power of Attorney: Grants the agent authority to act on specific issues or for a designated time period.

How do I create a Power of Attorney in Florida?

To create a Power of Attorney in Florida, the principal must complete a written document that clearly states the powers being granted. The document must be signed by the principal and witnessed by two individuals or notarized. It is advisable to ensure it meets all legal requirements to avoid potential challenges later.

Can I revoke a Power of Attorney in Florida?

Yes, a principal can revoke a Power of Attorney at any time as long as they are mentally competent. This can be done by providing written notice to the agent and any relevant third parties who may rely on the Power of Attorney. It is also wise to file a revocation document with the same authority that held the original Power of Attorney.

What happens if I do not have a Power of Attorney and become incapacitated?

If an individual becomes incapacitated without a Power of Attorney in place, family members may have to go through the court system to seek guardianship. This process can be lengthy, costly, and may not align with the individual’s wishes. Having a Power of Attorney helps avoid such complications.

Is a Florida Power of Attorney valid in other states?

A Florida Power of Attorney is generally recognized in other states, but each state has its own laws regarding the document's effectiveness. It is advisable to check the specific laws in the state where the Power of Attorney will be used. Depending on local requirements, it may be beneficial to create a new Power of Attorney that complies with that state’s laws.

Can my agent act on my behalf in medical decisions?

A standard Power of Attorney primarily covers financial and legal matters. However, to designate someone to make medical decisions on your behalf, you would need to create a separate document known as a Health Care Surrogate Designation. This allows your agent to make healthcare decisions if you are unable to communicate your wishes.