What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the ownership and operational procedures of a limited liability company (LLC) in Florida. It defines roles, responsibilities, and how decisions are made. Importantly, it helps protect members' personal assets by clearly delineating the company's operations.

Is an Operating Agreement required in Florida?

No, Florida law does not mandate an Operating Agreement for LLCs. However, having one is highly recommended. It can prevent disputes among members, clarify expectations, and ensure smoother operations. Without it, the business may default to state laws, which may not align with your intentions.

What should be included in an Operating Agreement?

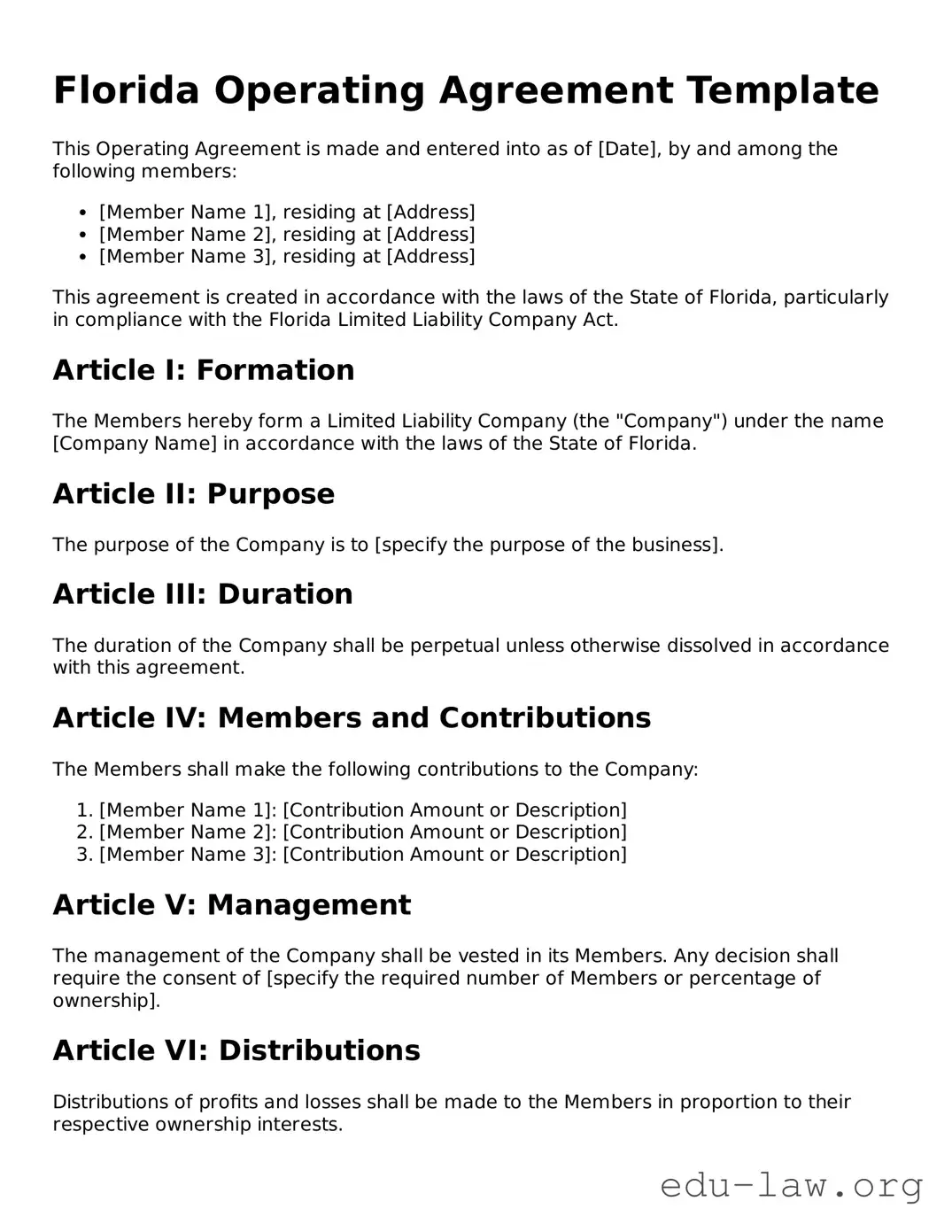

Typically, an Operating Agreement should include information about ownership structure, voting rights, profit distribution, member duties, and how to handle member changes or business dissolution. Including a procedure for resolving disputes is also wise. The more detailed, the better you can govern your LLC.

How do I create an Operating Agreement?

You can draft an Operating Agreement yourself or hire a legal professional for assistance. Begin with a template or document outlining key provisions relevant to your LLC. Customize it to fit your specific needs. Once finalized, all members must sign the document to make it effective.

Can the Operating Agreement be changed?

Yes, the Operating Agreement can be amended. Changes are common as businesses evolve. It's essential to outline the amendment process in the original agreement. Usually, it requires a certain percentage of members' approval. Document any changes formally and have all members sign the updated agreement.

What happens if there is no Operating Agreement?

If you lack an Operating Agreement, your LLC may operate under Florida's default rules. This might lead to outcomes that don’t match your intentions or expectations. Disputes among members may arise more frequently without established guidelines. Therefore, having one is crucial for clarity.

Is it necessary for single-member LLCs to have an Operating Agreement?

While not legally required, it’s good practice for single-member LLCs to have an Operating Agreement. It demonstrates separation between personal and business assets, providing extra protection against liability claims. It also simplifies any future transitions, like adding members or selling the business.

Where should I keep my Operating Agreement?

Your Operating Agreement should be stored in a safe, accessible location. It can be kept digitally or physically, but ensure that all members have access to it. Keeping backups is also smart, in case the original document is lost or damaged.