What is a Last Will and Testament in Florida?

A Last Will and Testament is a legal document that outlines how an individual's assets and affairs should be handled after their death. In Florida, it acts as a guide to ensure that your wishes regarding the distribution of your property are honored. It can also name guardians for minor children and designate an executor who will carry out your wishes.

Who can create a Last Will and Testament in Florida?

In Florida, any individual who is at least 18 years old and of sound mind can create a Last Will and Testament. This means they must understand the implications of making a will and be capable of making decisions about their assets.

What are the requirements for a valid will in Florida?

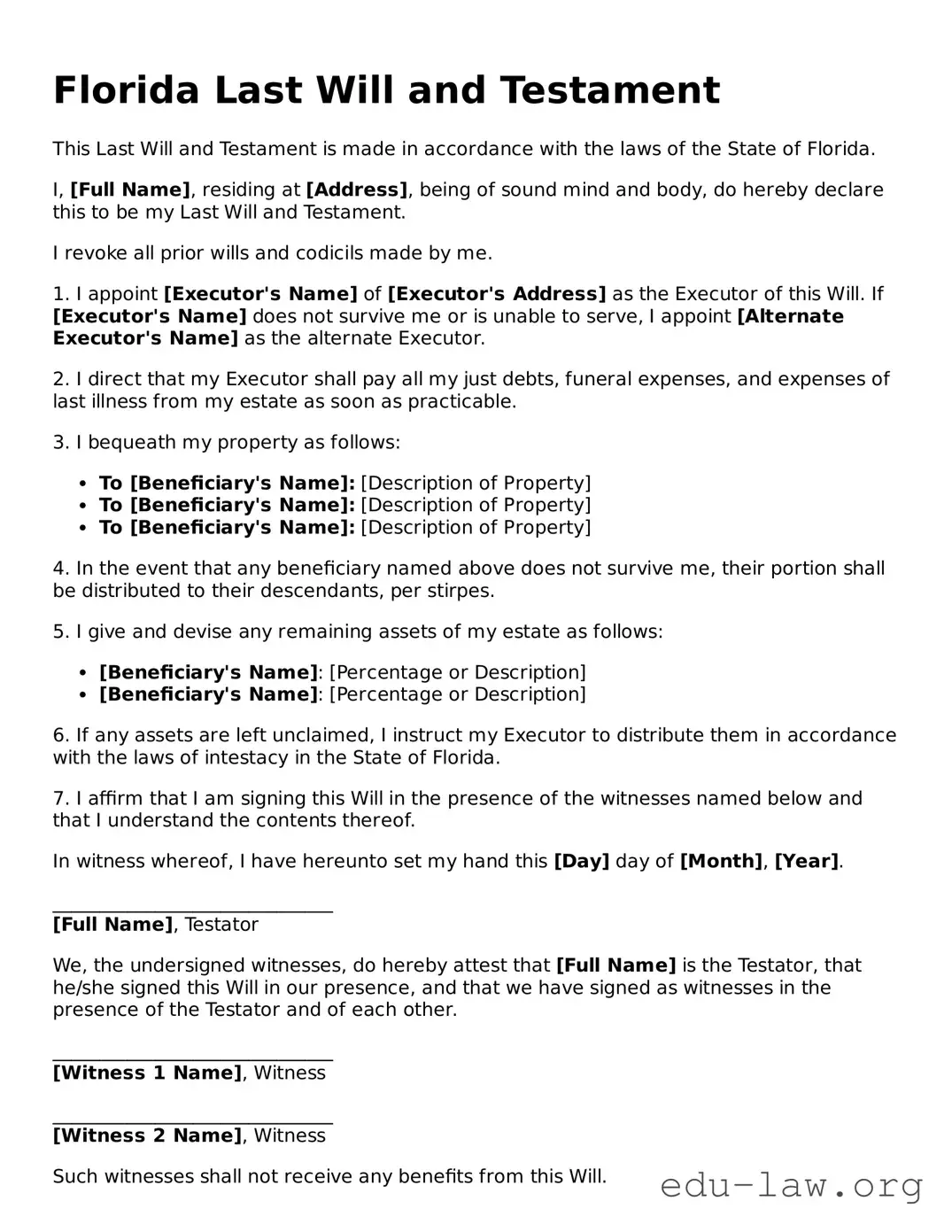

A Last Will and Testament in Florida must be in writing and signed by the person making the will (the testator). Additionally, it should be witnessed by at least two individuals who are not beneficiaries of the will. These witnesses must sign the will in the presence of the testator.

Can I make changes to my will after it is created?

Yes, you can make changes to your Last Will and Testament at any time while you are still alive. This can be done by creating a new will or by drafting a legal document called a codicil, which serves as an amendment to the existing will. Be sure to follow the same legal requirements for signing and witnessing as with the original will.

What happens if I die without a will in Florida?

If you die without a will, your assets will be distributed according to Florida's intestacy laws. This means that your belongings will be divided among your relatives based on their relationship to you. This distribution may not align with your wishes, making it essential to create a will if you have specific intentions for your estate.

Can I name an executor in my Florida will?

Absolutely! In your Last Will and Testament, you can name an executor who will be responsible for carrying out the wishes you've outlined. This person will manage your estate, pay off any debts, and distribute the remaining assets according to your instructions. Choose someone you trust to handle these responsibilities thoughtfully and efficiently.

Is it necessary to notarize my will in Florida?

In Florida, notarization is not required for a Last Will and Testament to be valid. However, if your will includes a self-proving affidavit—an additional document that contains statements from you and your witnesses affirming the will’s validity—then it can make the probate process easier by eliminating the need for witnesses to testify in court.

How can I ensure my will is kept safe?

Once you have created your Last Will and Testament, it's important to store it in a safe location. Consider keeping it in a safe deposit box, a personal safe, or with your attorney. Additionally, inform your executor and close family members where it is located to ensure that it can be accessed when needed.

What should I do if I want to revoke a will?

If you want to revoke a Last Will and Testament, you can do so by creating a new will that explicitly states that all previous wills are revoked. Alternatively, you can physically destroy the old will with the clear intention of revoking it. Always ensure that the new will complies with Florida’s legal requirements to avoid confusion.

Can I disinherit someone in my Florida will?

Yes, you can disinherit someone in your will. To do this, it’s recommended to specifically mention the person you are disinheriting and state your intentions clearly. Keep in mind that while you can disinherit children and relatives, they may have certain rights under Florida law, so it’s wise to seek guidance if disinheritance is a concern.