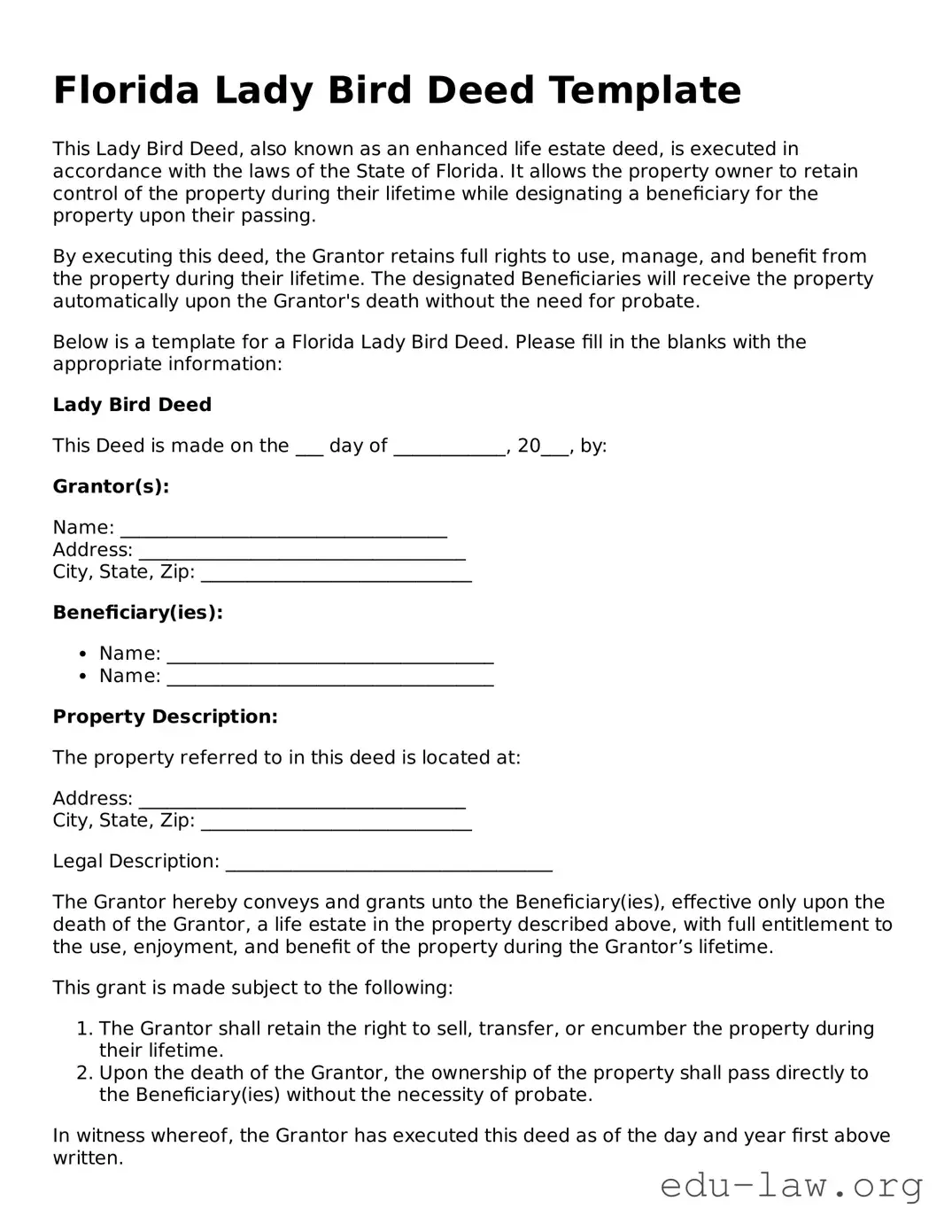

Florida Lady Bird Deed Template

This Lady Bird Deed, also known as an enhanced life estate deed, is executed in accordance with the laws of the State of Florida. It allows the property owner to retain control of the property during their lifetime while designating a beneficiary for the property upon their passing.

By executing this deed, the Grantor retains full rights to use, manage, and benefit from the property during their lifetime. The designated Beneficiaries will receive the property automatically upon the Grantor's death without the need for probate.

Below is a template for a Florida Lady Bird Deed. Please fill in the blanks with the appropriate information:

Lady Bird Deed

This Deed is made on the ___ day of ____________, 20___, by:

Grantor(s):

Name: ___________________________________

Address: ___________________________________

City, State, Zip: _____________________________

Beneficiary(ies):

- Name: ___________________________________

- Name: ___________________________________

Property Description:

The property referred to in this deed is located at:

Address: ___________________________________

City, State, Zip: _____________________________

Legal Description: ___________________________________

The Grantor hereby conveys and grants unto the Beneficiary(ies), effective only upon the death of the Grantor, a life estate in the property described above, with full entitlement to the use, enjoyment, and benefit of the property during the Grantor’s lifetime.

This grant is made subject to the following:

- The Grantor shall retain the right to sell, transfer, or encumber the property during their lifetime.

- Upon the death of the Grantor, the ownership of the property shall pass directly to the Beneficiary(ies) without the necessity of probate.

In witness whereof, the Grantor has executed this deed as of the day and year first above written.

____________________________________

(Grantor's Signature)

____________________________________

(Print Name)

Witnessed by:

____________________________________

(Signature of Witness)

____________________________________

(Print Name of Witness)

____________________________________

(Signature of Second Witness)

____________________________________

(Print Name of Second Witness)

STATE OF FLORIDA

COUNTY OF _________________________

On this ___ day of ____________, 20___, before me, a Notary Public, personally appeared the above-named Grantor(s), known to me or confirmed by me through satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

____________________________________

Notary Public

My Commission Expires: ________________