What is a Florida Hold Harmless Agreement?

A Florida Hold Harmless Agreement is a legal document in which one party agrees to protect another party from any claims, damages, or liabilities that may arise from specific activities or situations. This type of agreement is commonly used in construction contracts, rental agreements, and various service contracts. It is designed to allocate risk, ensuring that one party does not bear financial responsibility for something that is not directly their fault.

Why would someone use a Hold Harmless Agreement?

Individuals or businesses often use Hold Harmless Agreements to mitigate the risk of legal claims. For example, a contractor may require a homeowner to sign this agreement before performing work, ensuring that if an accident occurs on the property, the contractor will not be held liable. This type of agreement can also provide peace of mind, knowing that the financial burden of unforeseen incidents is shared or transferred.

Are Hold Harmless Agreements enforceable in Florida?

Yes, Hold Harmless Agreements are generally enforceable in Florida, provided they meet certain legal requirements. The language used in the agreement must be clear and specific, outlining the extent of the liability being waived. It is also essential that both parties fully understand the agreement before signing it. Courts will often uphold these agreements if they are constructed properly and do not violate public policy.

Can a Hold Harmless Agreement protect against gross negligence or intentional misconduct?

Typically, a Hold Harmless Agreement does not protect against gross negligence or intentional wrongdoing. The intent of this agreement is to limit liability for ordinary negligence. In many cases, courts may refuse to enforce the agreement if it attempts to waive responsibility for extreme negligence or intentional actions. Thus, individuals should review the terms of the agreement carefully to understand its limitations.

How does a Hold Harmless Agreement differ from insurance?

A Hold Harmless Agreement is a contractual agreement between parties that outlines liability responsibilities. In contrast, insurance is a financial product that provides coverage for potential losses. While a Hold Harmless Agreement shifts the liability to another party, insurance can help cover the costs associated with claims, damages, and legal fees. Both can work together, but they serve different purposes in risk management.

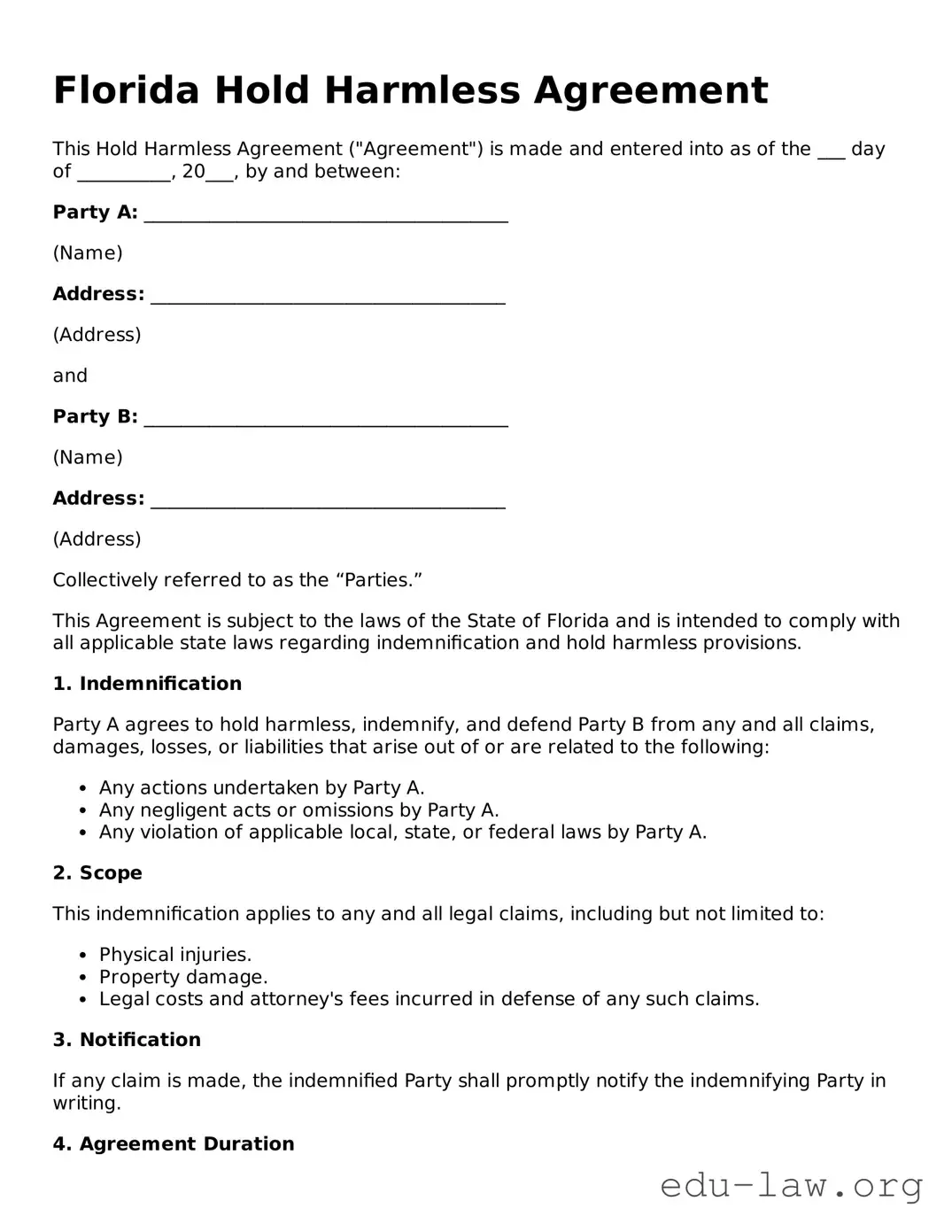

What should be included in a Hold Harmless Agreement?

A Hold Harmless Agreement should include essential details such as the names of the parties involved, the specific activities or situations covered, and a clear statement outlining the extent of the liability being waived. It is also advisable to include provisions regarding legal jurisdiction, governing laws, and termination clauses. Clarity in wording is crucial to avoid misunderstandings later on.

Is it advisable to consult a lawyer before signing a Hold Harmless Agreement?

Yes, consulting a lawyer before signing a Hold Harmless Agreement is highly advisable. An attorney can review the terms of the agreement to ensure that it is legally sound and effectively protects your interests. They can also provide guidance on any potential risks involved and advise on how to negotiate terms that may be more favorable. This step can be invaluable in preventing future legal challenges.

Can a Hold Harmless Agreement be revoked or modified?

Yes, a Hold Harmless Agreement can be revoked or modified, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both parties to ensure enforceability. If one party wishes to revoke the agreement, it is important to communicate this intention clearly and follow the terms specified in the original agreement regarding termination.