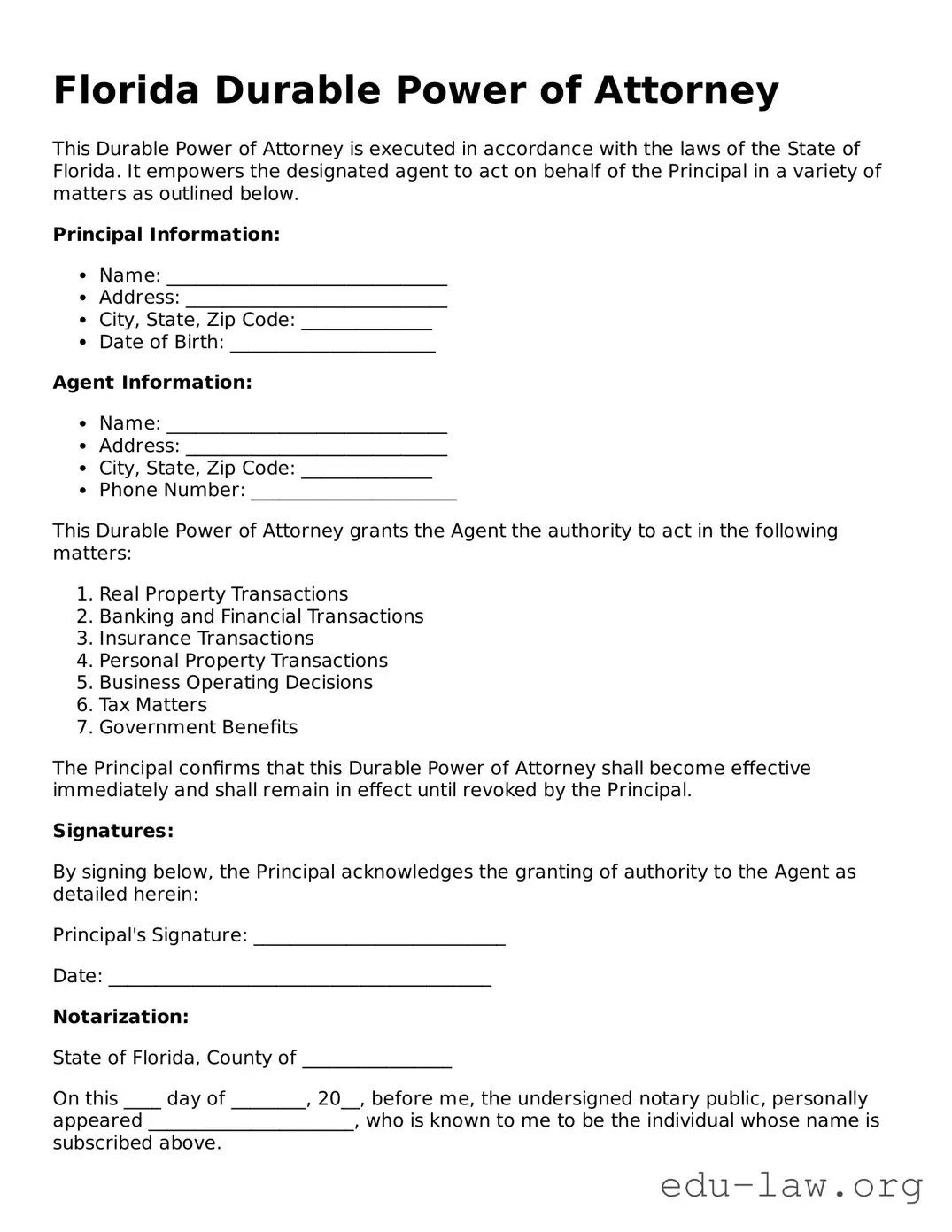

Florida Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the State of Florida. It empowers the designated agent to act on behalf of the Principal in a variety of matters as outlined below.

Principal Information:

- Name: ______________________________

- Address: ____________________________

- City, State, Zip Code: ______________

- Date of Birth: ______________________

Agent Information:

- Name: ______________________________

- Address: ____________________________

- City, State, Zip Code: ______________

- Phone Number: ______________________

This Durable Power of Attorney grants the Agent the authority to act in the following matters:

- Real Property Transactions

- Banking and Financial Transactions

- Insurance Transactions

- Personal Property Transactions

- Business Operating Decisions

- Tax Matters

- Government Benefits

The Principal confirms that this Durable Power of Attorney shall become effective immediately and shall remain in effect until revoked by the Principal.

Signatures:

By signing below, the Principal acknowledges the granting of authority to the Agent as detailed herein:

Principal's Signature: ___________________________

Date: _________________________________________

Notarization:

State of Florida, County of ________________

On this ____ day of ________, 20__, before me, the undersigned notary public, personally appeared ______________________, who is known to me to be the individual whose name is subscribed above.

Notary Public Signature: ____________________________

Commission Number: ________________________________

My Commission Expires: ____________________________