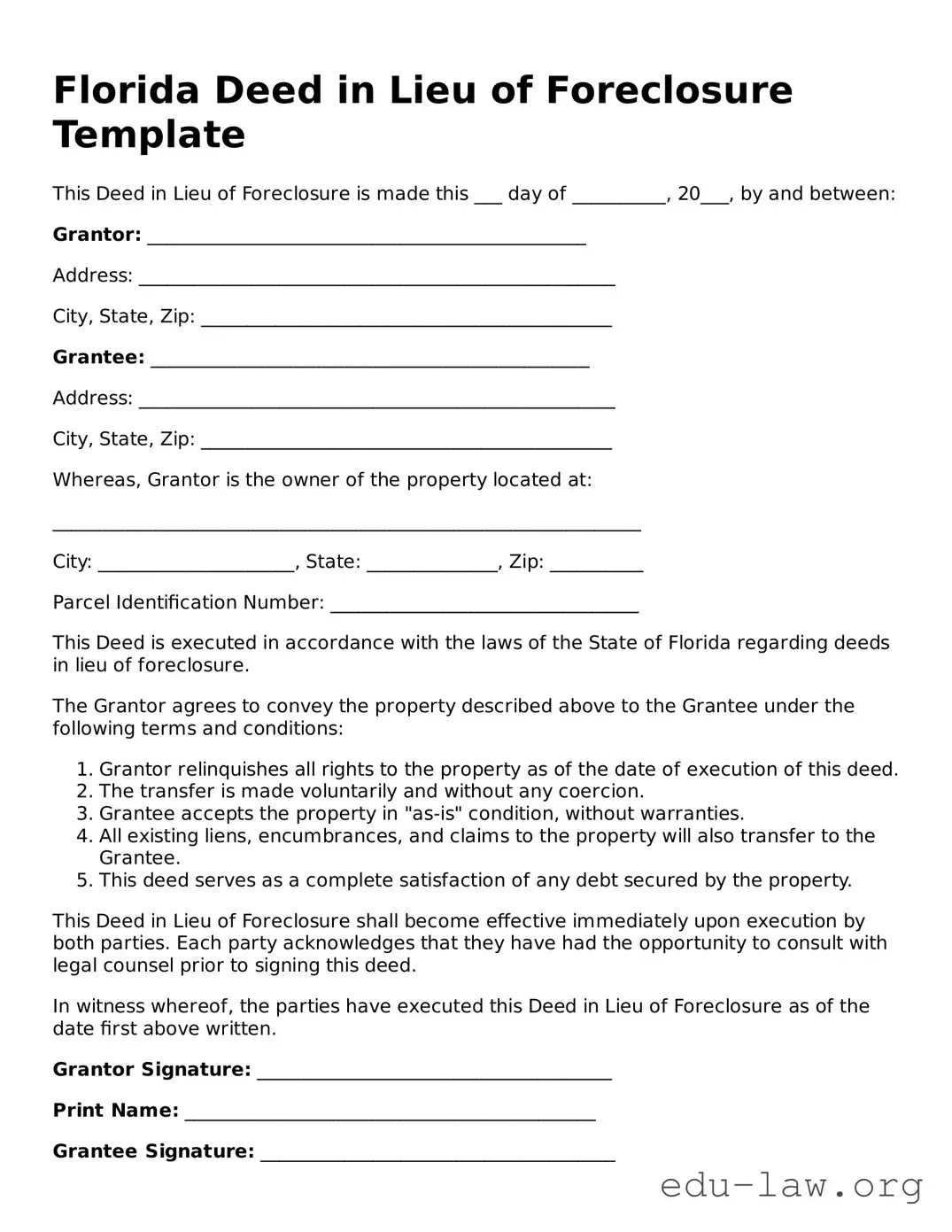

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20___, by and between:

Grantor: _______________________________________________

Address: ___________________________________________________

City, State, Zip: ____________________________________________

Grantee: _______________________________________________

Address: ___________________________________________________

City, State, Zip: ____________________________________________

Whereas, Grantor is the owner of the property located at:

_______________________________________________________________

City: _____________________, State: ______________, Zip: __________

Parcel Identification Number: _________________________________

This Deed is executed in accordance with the laws of the State of Florida regarding deeds in lieu of foreclosure.

The Grantor agrees to convey the property described above to the Grantee under the following terms and conditions:

- Grantor relinquishes all rights to the property as of the date of execution of this deed.

- The transfer is made voluntarily and without any coercion.

- Grantee accepts the property in "as-is" condition, without warranties.

- All existing liens, encumbrances, and claims to the property will also transfer to the Grantee.

- This deed serves as a complete satisfaction of any debt secured by the property.

This Deed in Lieu of Foreclosure shall become effective immediately upon execution by both parties. Each party acknowledges that they have had the opportunity to consult with legal counsel prior to signing this deed.

In witness whereof, the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor Signature: ______________________________________

Print Name: ____________________________________________

Grantee Signature: ______________________________________

Print Name: ____________________________________________

This document should be notarized and recorded in the appropriate county office.