What is a Florida Bill of Sale?

A Bill of Sale in Florida is a legal document that serves as a receipt for the sale of personal property. It details the transaction between the buyer and seller, covering essential information such as the description of the item, the sale price, and the date of the transaction. This form provides proof of ownership, which can be important for registration and insurance purposes.

Do I need a Bill of Sale for a vehicle in Florida?

Yes, a Bill of Sale is necessary for vehicle transactions in Florida. While it is not mandated by law for private sales, it greatly aids in the registration process at the Department of Highway Safety and Motor Vehicles (DHSMV). It helps document the transfer of ownership from the seller to the buyer, ensuring that all parties have a record of the sale.

What information is required in a Florida Bill of Sale?

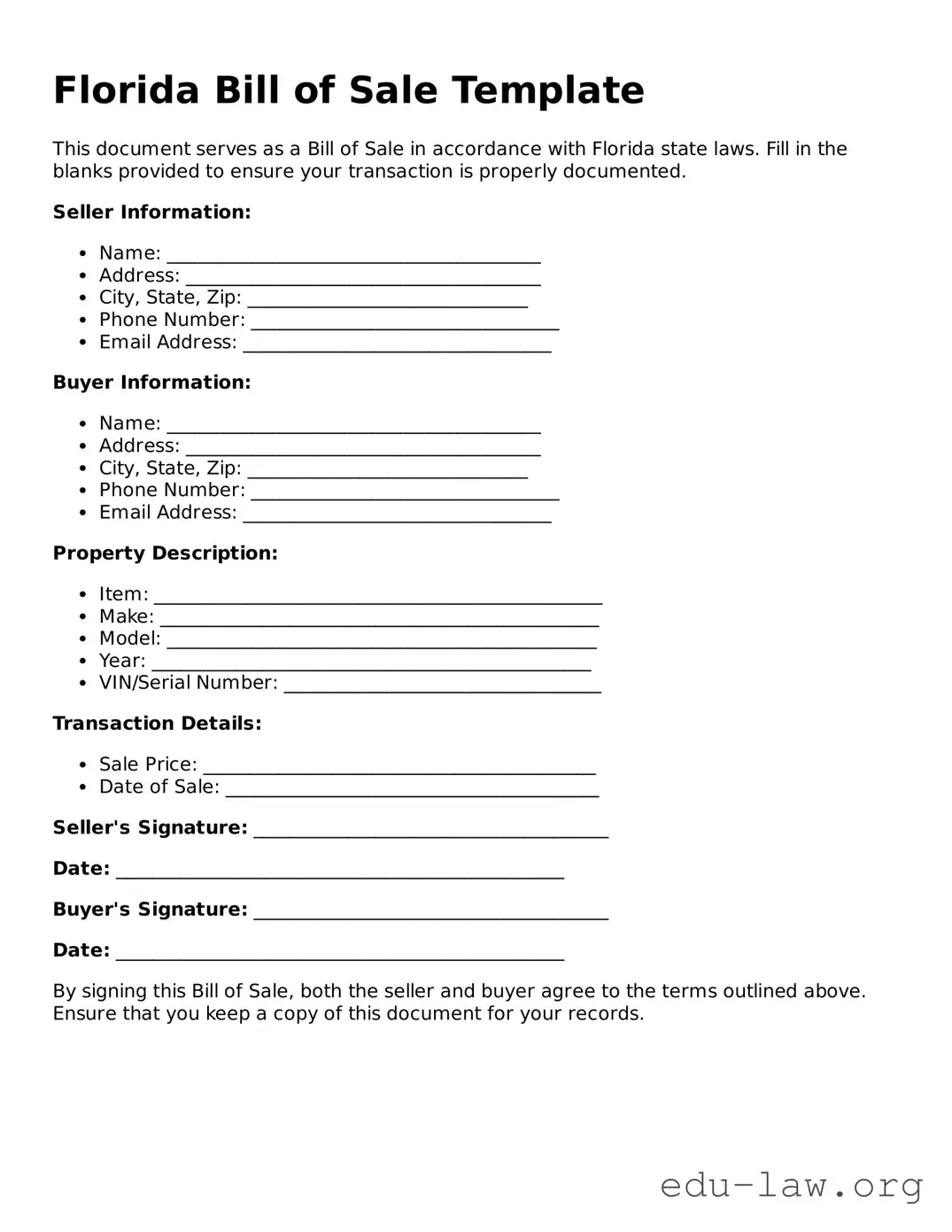

A comprehensive Bill of Sale should include the following information: the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including VIN for vehicles), the sale price, the date of the transaction, and any relevant signatures. Additional details, such as warranties or conditions of sale, can also be included for clarity.

Is a notarized Bill of Sale required in Florida?

No, notarization is not required in Florida for a Bill of Sale to be valid. However, having the document notarized can provide additional legal protection and authenticity to the transaction. It helps confirm the identities of the parties involved and witnesses their signatures, which can be beneficial in case of future disputes.

Where can I obtain a Bill of Sale form in Florida?

Florida residents can find Bill of Sale forms readily available online. Many websites offer free or paid templates that comply with state laws. Alternatively, you can draft your own Bill of Sale using the required information, ensuring that it meets all pertinent specifications and details of the transaction.

Can I use a generic Bill of Sale in Florida?

Yes, a generic Bill of Sale can be used in Florida, provided it includes all necessary information specific to the transaction. If you opt for a generic form, ensure that it clearly states all details relevant to the sold item and the parties involved. Customizing a generic form may help prevent any misunderstandings later on.

What happens if I lose my Bill of Sale?

If you lose a Bill of Sale, it can complicate matters if you need to prove ownership of an item. To remedy this, you can often rebuild a record of the transaction by contacting the seller or buyer to obtain a copy. In some cases, a replacement Bill of Sale can be drafted that confirms the original transaction details, assuming both parties agree.

How long should I keep my Bill of Sale?

It is advisable to retain a copy of your Bill of Sale for a minimum of three to five years after the transaction, especially for significant purchases like vehicles or other valuables. Keeping this documentation may prove vital for tax purposes, resale, or if any disputes arise concerning ownership or condition of the sold item.

Can a Bill of Sale affect taxes?

Yes, a Bill of Sale can have implications for taxes, particularly regarding sales tax obligations. In Florida, sales of certain items may require the seller to collect sales tax from the buyer. It's essential to consult local regulations to ensure compliance and understand how the Bill of Sale may impact tax filings.

Do I need a Bill of Sale for a gift?

A Bill of Sale is not typically required for gifts, as there is no exchange of money involved. However, if the item in question is significant in value—such as a vehicle—it may still be prudent to document the transaction with a Bill of Sale. This practice can help clarify ownership transfer and protect both parties in case of future ownership disputes or legal questions.