What is an Employee Advance form?

The Employee Advance form is a document that allows employees to request an advance on their salary or wages. This form facilitates the process of obtaining funds for emergencies or immediate needs before the regular paycheck is issued. It's designed to provide a structured method for employees to receive financial assistance while maintaining clear records for the employer.

Who is eligible to complete an Employee Advance form?

Typically, all employees who are on the payroll may be eligible to submit an Employee Advance form. However, policies may vary by company. Employees should check their employer's specific guidelines to understand eligibility criteria, which can include tenure with the company and current financial status.

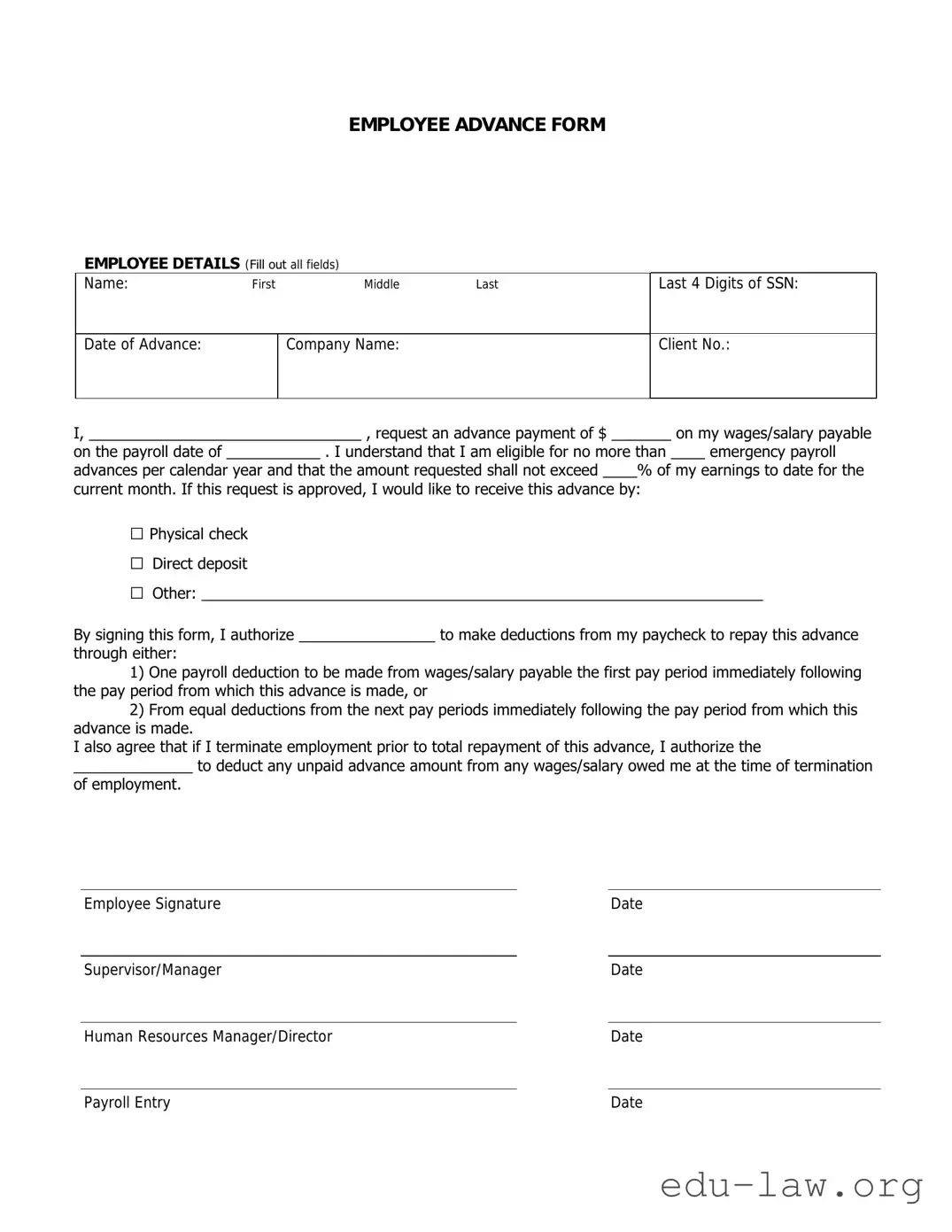

What information is required on the form?

The Employee Advance form generally requires the employee's personal details, including name, employee ID, and department. Additionally, the form may ask for the amount requested, the reason for the advance, and proposed repayment terms. This information helps HR assess the request and maintain accurate records.

How is the advance amount determined?

The advance amount can vary based on company policies and individual circumstances. Employers typically take into account the employee’s salary, the reason for the request, and the employee’s repayment capacity. Some companies may have a cap on the maximum amount of advance an employee can request.

What happens after I submit my Employee Advance form?

After submission, the form will be reviewed by HR or the finance department. They will evaluate the request based on company policy and the information provided. Employees will typically receive a response within a specific time frame, outlining whether the advance is approved and the details of repayment.