What is a Durable Power of Attorney?

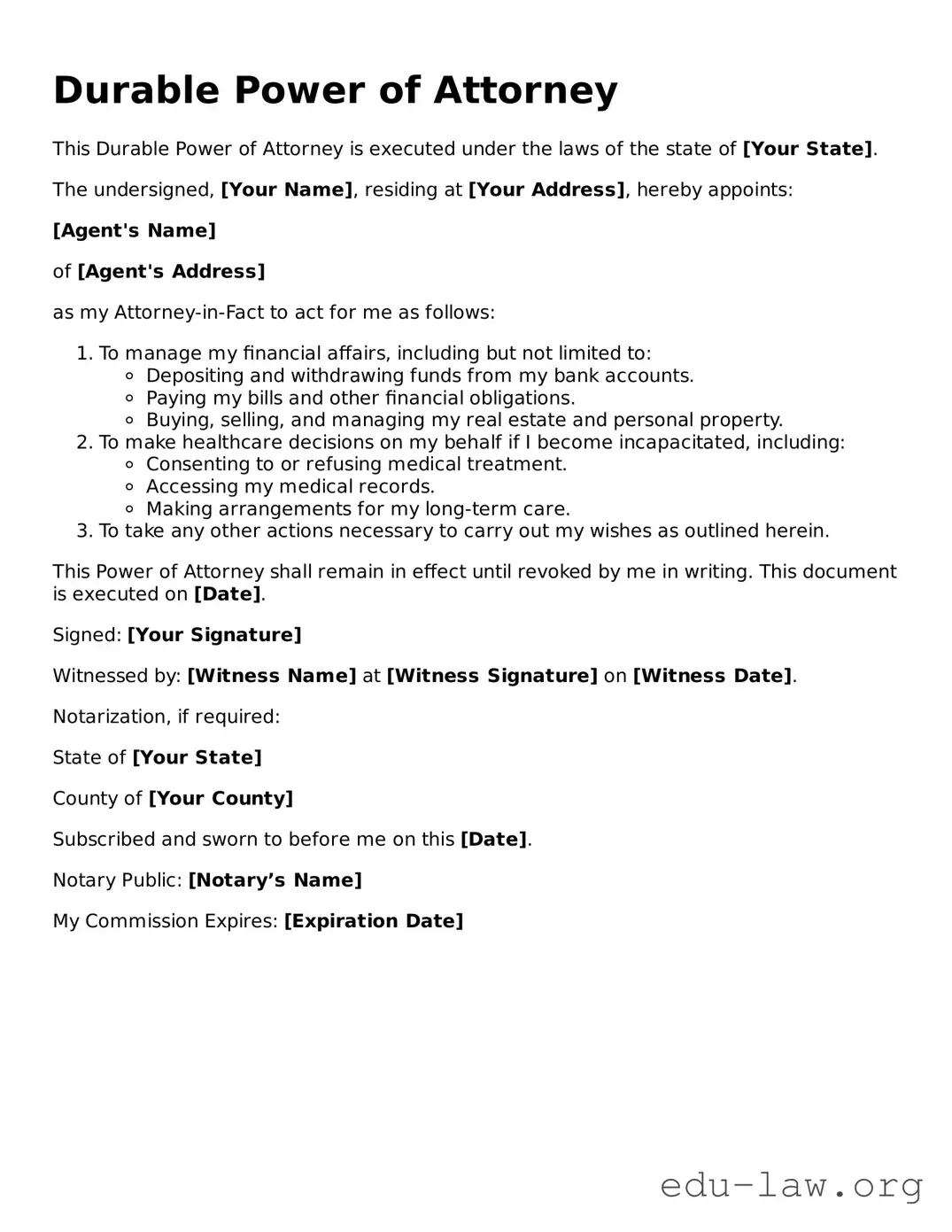

A Durable Power of Attorney (DPOA) is a legal document that allows you to designate someone to manage your financial affairs or make decisions on your behalf if you become incapacitated. Unlike a standard power of attorney, which becomes void if you become mentally or physically unable to make your own decisions, a durable one remains in effect even in such situations.

Why do I need a Durable Power of Attorney?

Having a DPOA in place ensures that someone you trust can handle your financial matters when you cannot. This can include paying bills, managing investments, or handling real estate transactions. It provides peace of mind and can help avoid legal complications for your loved ones during a challenging time.

Who can be appointed as an agent under a Durable Power of Attorney?

Generally, you can choose any adult you trust to act as your agent, including family members, friends, or professionals like attorneys or financial advisors. However, it's crucial to select someone responsible and capable of managing your affairs appropriately.

Is a Durable Power of Attorney effective immediately?

A Durable Power of Attorney can be set up to become effective immediately or only upon your incapacitation. It’s entirely up to you. If you choose it to be effective immediately, your agent has the authority to act right away. If you want it to kick in only when you become incapacitated, you should specify that in the document.

Are there any limitations to what my agent can do?

Your agent has the authority to perform tasks you specify in the DPOA. However, there are common restrictions, such as making changes to your will or personal healthcare decisions unless explicitly granted. It’s essential to clearly outline the powers you want your agent to have when drafting the document.

How do I revoke a Durable Power of Attorney?

You can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should provide written notice to your agent, any financial institutions or organizations that may have the DPOA on file, and may also consider filing a formal revocation document with the state if required. It’s important to communicate clearly to avoid confusion.

Do I need a lawyer to create a Durable Power of Attorney?

While it’s not legally required to have a lawyer draft a Durable Power of Attorney, consulting one can be beneficial. An attorney can ensure that the document complies with state laws and accurately reflects your wishes, reducing the risk of any disputes or complications down the line.

Can a Durable Power of Attorney be challenged or revoked by someone else?

While a DPOA represents your wishes, it can be challenged in court, particularly if someone believes you were not mentally competent when you signed it or if there is evidence of fraud or undue influence. However, as long as you are of sound mind when creating it and clear about your desires, it typically stands up against challenges.

What happens to the Durable Power of Attorney if I pass away?

A Durable Power of Attorney automatically becomes null and void upon your death. At that point, your estate would be handled according to your will, or according to state intestacy laws if you don’t have a will. It’s advisable to have a comprehensive estate plan in place that works in conjunction with your DPOA.