What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender in exchange for forgiveness of the mortgage debt. This option can help avoid the lengthy foreclosure process and may have less of a negative impact on your credit score compared to foreclosure proceedings.

Who is eligible for a Deed in Lieu of Foreclosure?

Generally, homeowners facing financial hardship who can no longer afford their mortgage payments may be eligible. However, a lender typically assesses each case individually. They may require evidence of financial distress, efforts to sell the property, and proof that the homeowner has exhausted all other options to resolve the debt.

What are the benefits of opting for a Deed in Lieu of Foreclosure?

One of the primary benefits is the potential to minimize damage to your credit score. A Deed in Lieu often reflects better on your credit report than a foreclosure. Additionally, the process can be quicker and less stressful than going through foreclosure. Homeowners may also have the opportunity to negotiate for relocation assistance or the waiver of any remaining mortgage balance.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, some drawbacks do exist. Homeowners will lose their property and all rights associated with it, which can be emotionally difficult. Additionally, the lender might require the homeowner to demonstrate that they are truly unable to keep the home. The process may also come with a waiting period before homeowners can qualify for a new mortgage in the future.

How does the process work?

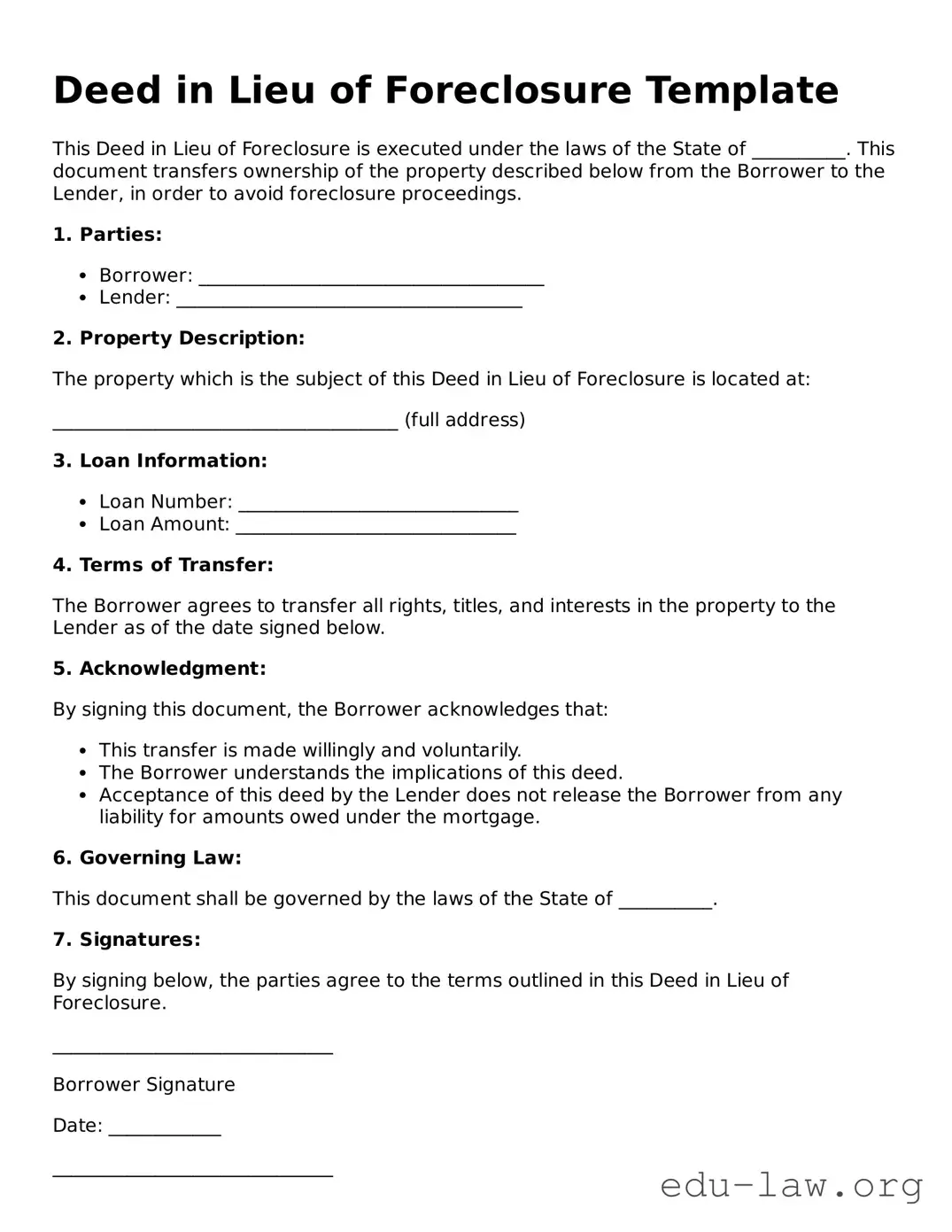

First, the homeowner must contact their lender to express interest in pursuing a Deed in Lieu of Foreclosure. If the lender agrees, they will typically ask for documentation regarding the homeowner's financial situation and the property's condition. Once approved, the homeowner will sign the Deed in Lieu, which transfers ownership. The lender may then cancel any remaining mortgage debt, and the homeowner will receive confirmation of their obligations being fulfilled.

What documents are needed to complete a Deed in Lieu of Foreclosure?

Homeowners will generally need to provide proof of income, bank statements, and any relevant financial disclosures. Additionally, the lender may ask for the original mortgage documents and a hardship letter that explains the reasons for the request. Documentation regarding any liens on the property will also be important to ensure a clean transfer.

Will a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure will impact your credit score, but typically less severely than a foreclosure. While it is still a negative mark, it may be viewed as more favorable, particularly if you can show that you acted in good faith by trying to resolve your financial situation rather than allowing the lender to foreclose.

Is it possible to negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, negotiation is often possible. Homeowners may wish to discuss aspects such as relocation assistance or terms of debt forgiveness. It is advisable to be open and transparent about your situation and needs, as this can lead to more favorable negotiations with the lender.

Can I stay in my home after signing a Deed in Lieu of Foreclosure?

Typically, once you sign the Deed in Lieu of Foreclosure, ownership is transferred to the lender, meaning you would need to vacate the property. However, some lenders may allow a short period for you to stay in the home before moving out, which can often be negotiated as part of the agreement.

What should I do if I’m considering a Deed in Lieu of Foreclosure?

Start by assessing your overall financial situation, and consider consulting with a housing counselor or an attorney specializing in real estate. They can provide insights into your options, the impacts on your credit, and the specific procedures involved. Engaging with your lender early in the process can also pave the way for a smoother transition.