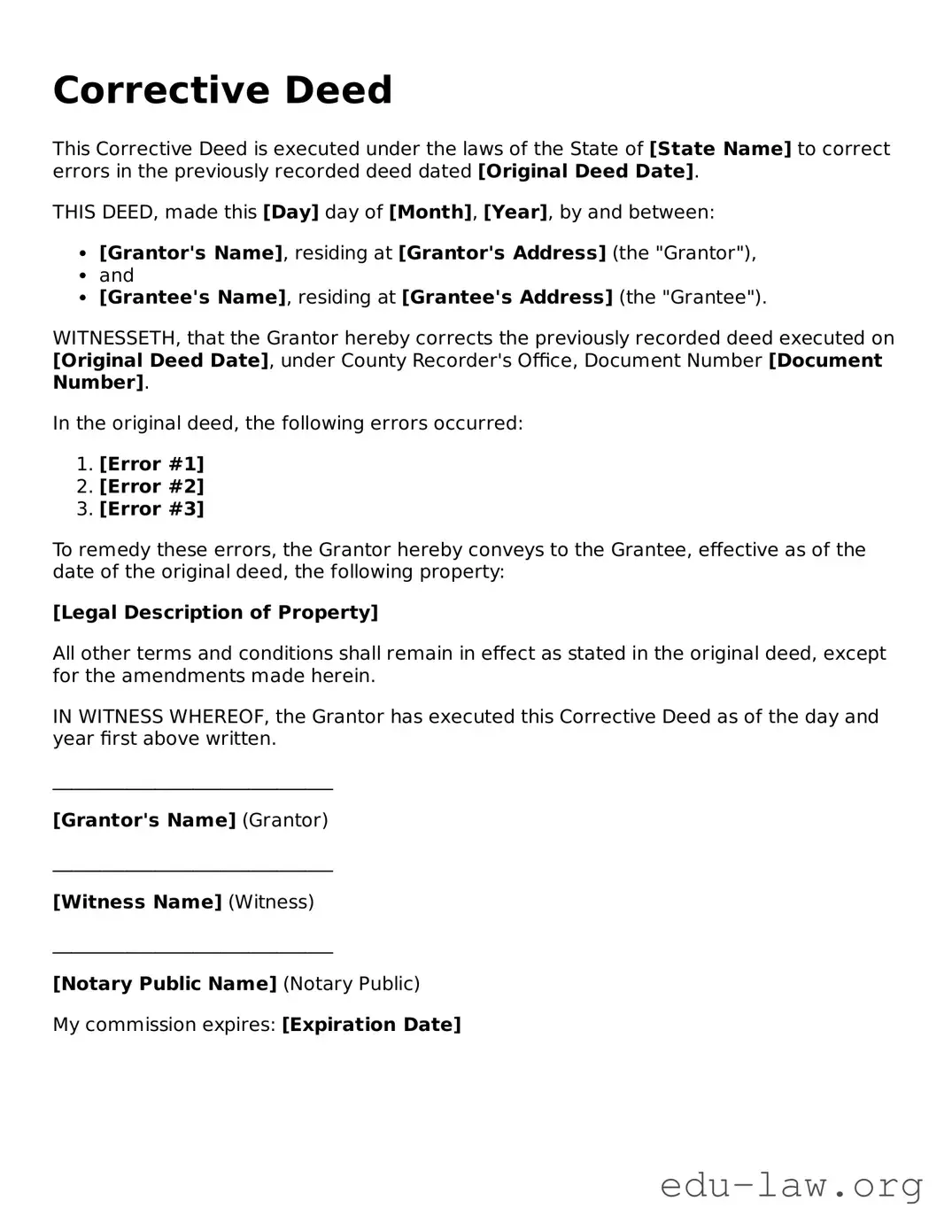

Corrective Deed

This Corrective Deed is executed under the laws of the State of [State Name] to correct errors in the previously recorded deed dated [Original Deed Date].

THIS DEED, made this [Day] day of [Month], [Year], by and between:

- [Grantor's Name], residing at [Grantor's Address] (the "Grantor"),

- and

- [Grantee's Name], residing at [Grantee's Address] (the "Grantee").

WITNESSETH, that the Grantor hereby corrects the previously recorded deed executed on [Original Deed Date], under County Recorder's Office, Document Number [Document Number].

In the original deed, the following errors occurred:

- [Error #1]

- [Error #2]

- [Error #3]

To remedy these errors, the Grantor hereby conveys to the Grantee, effective as of the date of the original deed, the following property:

[Legal Description of Property]

All other terms and conditions shall remain in effect as stated in the original deed, except for the amendments made herein.

IN WITNESS WHEREOF, the Grantor has executed this Corrective Deed as of the day and year first above written.

______________________________

[Grantor's Name] (Grantor)

______________________________

[Witness Name] (Witness)

______________________________

[Notary Public Name] (Notary Public)

My commission expires: [Expiration Date]