What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document you fill out to authorize your employer or any other entity to deposit your paycheck, benefits, or other payments directly into your Citibank account. This process eliminates the need for paper checks and speeds up access to your funds.

How do I obtain the Direct Deposit form?

You can get the Direct Deposit form directly from your employer or download it from Citibank's official website. Ensure that you are using the most updated version to avoid any issues.

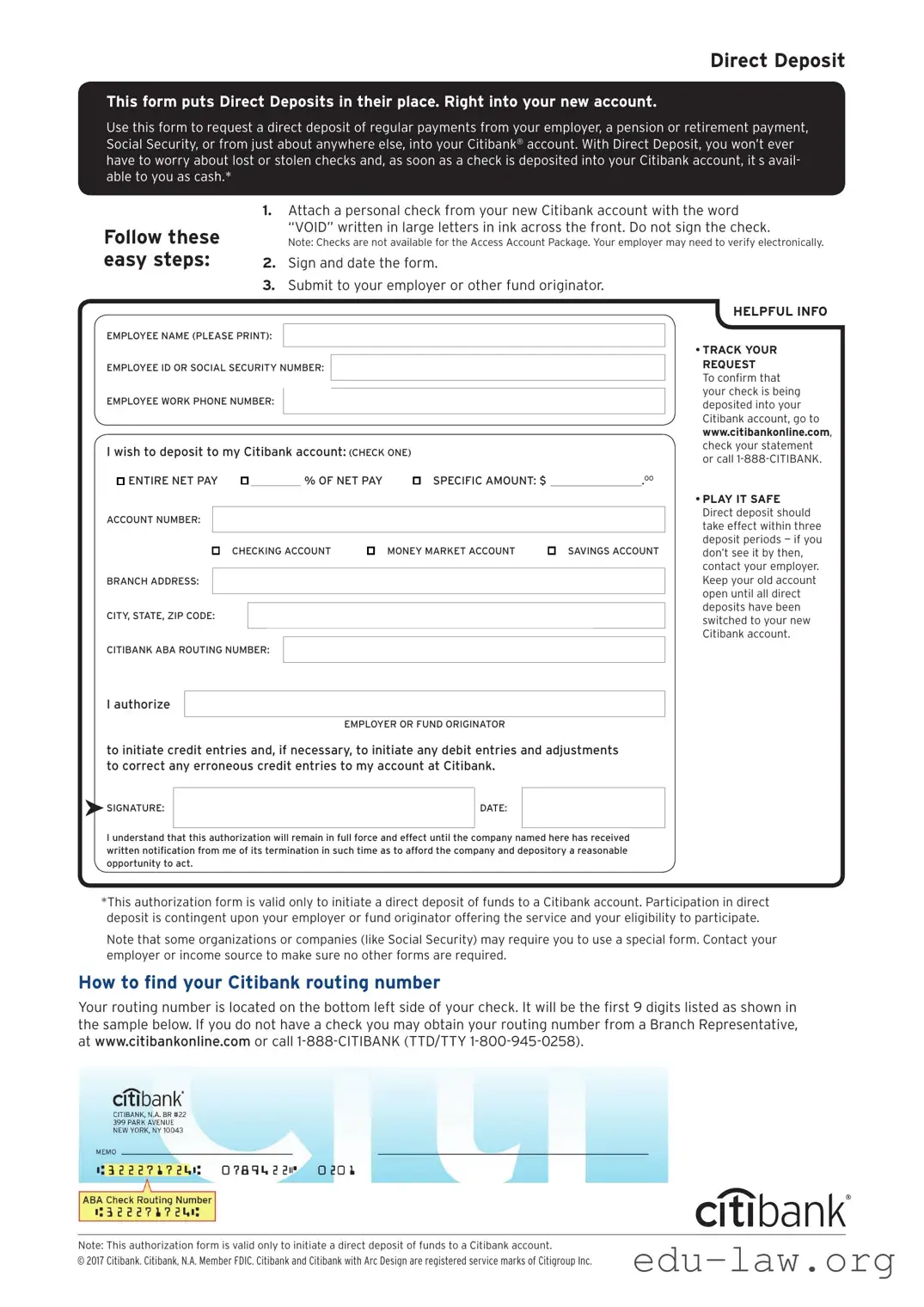

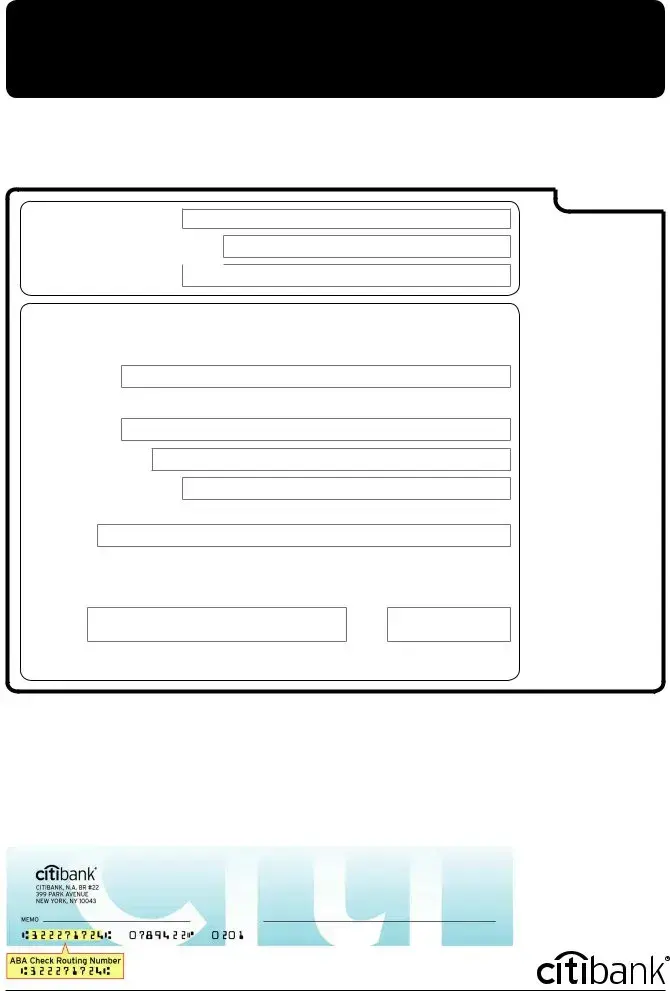

What information do I need to fill out the form?

Typically, you will need to provide your personal information, like your name, address, Social Security Number (or tax identification number), your bank account number, and the routing number for your Citibank account. It's essential to double-check this information to avoid delays in processing.

Is it safe to provide my bank information on the form?

Yes, it is generally safe to provide your bank information on the Direct Deposit form. However, you should only share it with trusted employers or organizations. Be cautious of phishing scams and always verify that you are using official channels.

How do I submit the Direct Deposit form after filling it out?

Once you have completed the form, submit it to your employer’s payroll department or the organization that will be providing the direct deposit. This can often be done in person or electronically, depending on your employer's policies.

How long does it take for Direct Deposit to start?

After submitting the form, it may take one to two pay cycles for the Direct Deposit to be processed and set up. This timeline can vary based on your employer's payroll system, so it’s a good idea to check in with them for specific information.

What should I do if my bank details change?

If you change your bank account or your routing number, it’s important to submit a new Direct Deposit form with your updated information. Notify your employer as soon as possible to avoid any issues with missed payments.

Do I need to keep a copy of the Direct Deposit form?

Yes, it's wise to keep a copy of the Direct Deposit form for your records. This can help you verify what information you provided and can serve as documentation in case any issues arise later.

Can I cancel my Direct Deposit at any time?

Yes, you can cancel your Direct Deposit at any time. To do so, inform your employer in writing and provide them with a new Direct Deposit form or a written letter of cancellation. Make sure to check on any specific procedures your employer may have for cancellations.

Who should I contact if I have questions about my Direct Deposit?

If you have questions about your Direct Deposit, reach out to your employer's payroll department. They should be able to provide assistance or direct you to the appropriate resources. Additionally, Citibank customer service is available if you have questions related to your account.

SIGNATURE:

SIGNATURE: