What is the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement is a document used to extend coverage under a Commercial General Liability (CGL) policy. It specifically adds additional insureds, such as owners, lessees, or contractors, to your insurance. This means that if someone else is harmed or has property damage as a result of your work, they may be covered under your policy as well, within the limits defined in the endorsement.

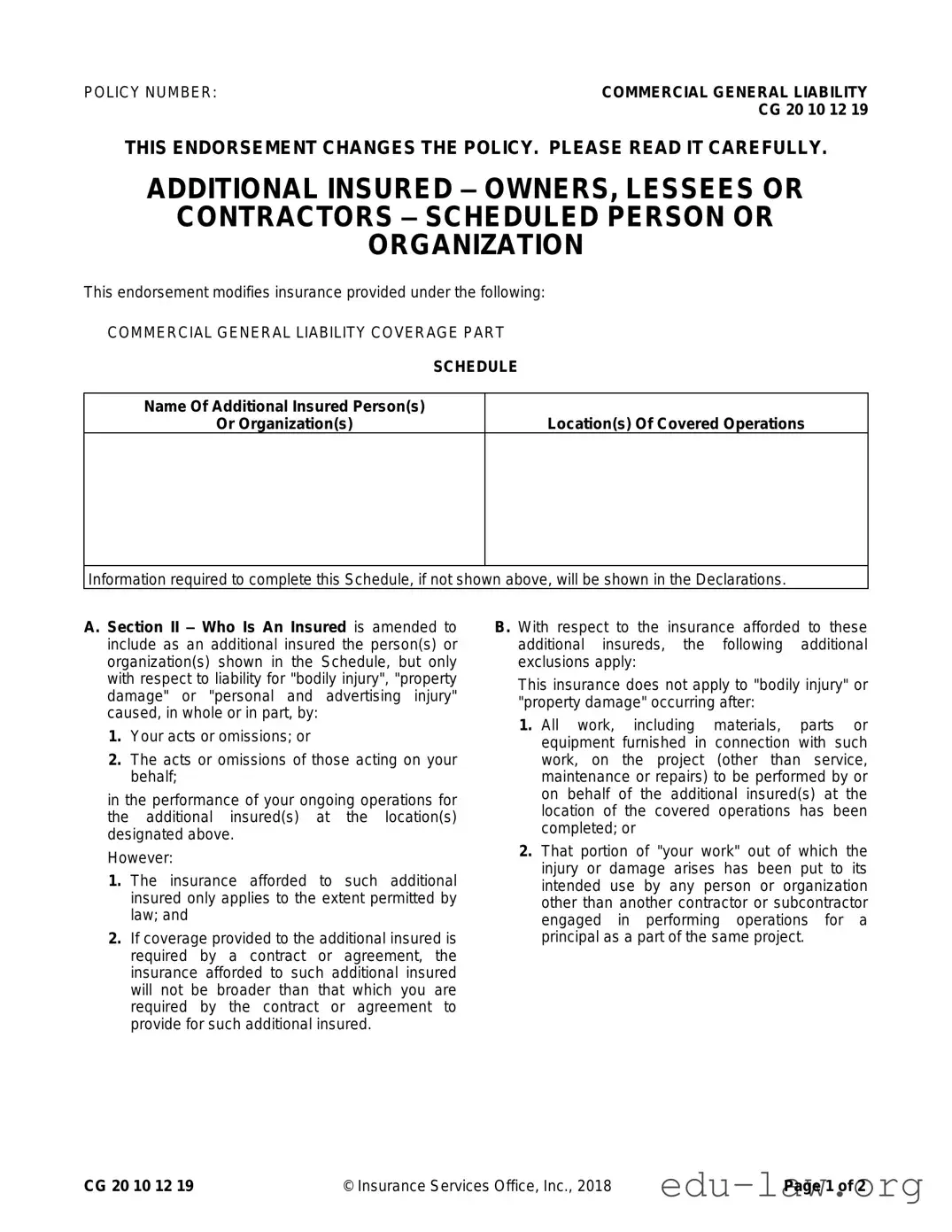

Who qualifies as an additional insured?

Additional insureds are usually specified individuals or organizations that you have a contractual obligation to cover. They can be owners, lessees, or contractors related to the work you are performing. Their names and details need to be included in the Schedule section of the endorsement for coverage to apply.

What types of incidents does this endorsement cover?

This endorsement covers claims related to bodily injury, property damage, or personal and advertising injury. However, it only applies if those incidents result from your actions or the actions of others working on your behalf while conducting operations for the additional insured at designated locations.

Are there any exclusions to this coverage?

Yes, there are specific exclusions. Coverage does not apply after all the work related to a project has been completed and no further service, maintenance, or repairs are being conducted. Additionally, if the injury or damage occurs after your work has been put to its intended use, the endorsement does not provide coverage.

How does the contract or agreement affect the additional insured coverage?

If coverage for the additional insured is required by a contract, the insurance will only extend to what is specified in that contract. This means that the protected amount cannot exceed what you’re obligated to provide through that agreement.

Will this endorsement increase my policy limits?

No, this endorsement does not increase the overall limits of your insurance policy. The coverage amounts still adhere to the original policy limits, and the most that will be paid on behalf of an additional insured will be the lesser of the required contract amount or the limits in your existing policy.

How do I fill out the Schedule on the endorsement?

The Schedule should include the names of all additional insured persons or organizations, as well as the locations where the insured operations will take place. If this information is not already specified, you will need to provide it in the Declarations section of your policy.

Can I modify who is listed as an additional insured?

Yes, you can modify the list of additional insureds by updating the Schedule in the endorsement. However, any changes should align with your insurance provider's guidelines and any applicable contracts to ensure that new parties are adequately covered.