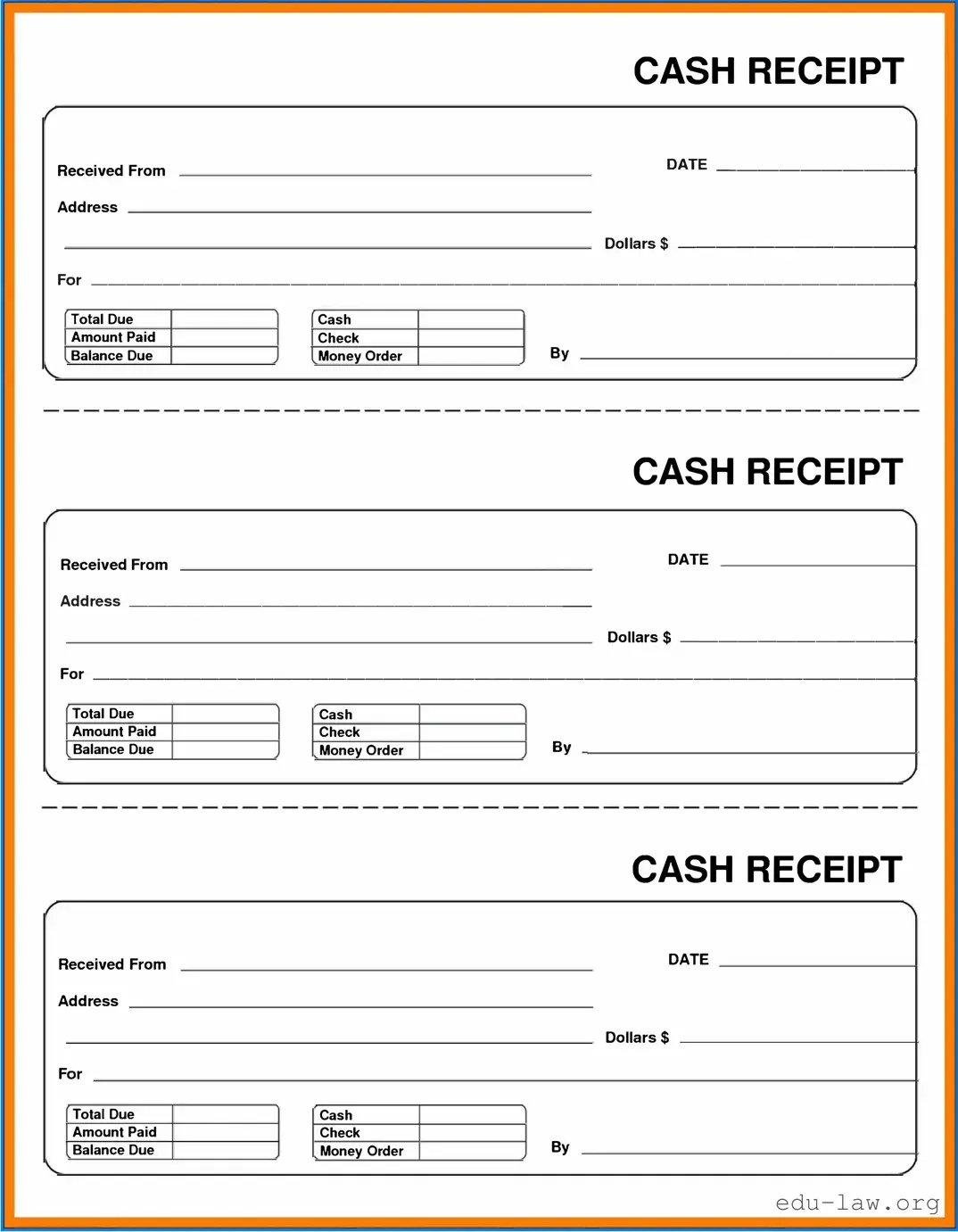

What is a Cash Receipt form?

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. It serves as proof that a transaction has occurred and that the specified amount has been received. Businesses commonly use this form to maintain accurate financial records and to provide customers with confirmation of their payment.

Why is a Cash Receipt form important?

Using a Cash Receipt form is crucial for both businesses and customers. For businesses, it ensures transparency and accountability, helping to prevent discrepancies in financial records. For customers, it provides a tangible record of their payment, which can be useful for warranty claims, returns, or audits. Overall, it fosters trust in the transaction process.

What information should be included on the Cash Receipt form?

A Cash Receipt form should typically include several key elements. This includes the date of the transaction, the amount of cash received, the name of the payer, a description of the goods or services paid for, and the signature of the person receiving the payment. Some forms may also include a unique receipt number for easier tracking.

How do I create a Cash Receipt form?

Creating a Cash Receipt form can be done easily, either by using a template or by designing one yourself. Many online resources and software programs offer pre-made templates that can be customized. Alternatively, you can draft your own form using a word processor, ensuring to include all the essential information necessary for the receipt.

Is a Cash Receipt form the same as an invoice?

No, a Cash Receipt form is not the same as an invoice. An invoice is a request for payment and specifies the amount owed, while a Cash Receipt form confirms that payment has already been made. In essence, invoices are issued before payment, whereas Cash Receipts are issued afterwards as proof of payment.

Who is responsible for issuing the Cash Receipt form?

The responsibility for issuing the Cash Receipt form typically falls on the person or entity receiving the payment. This might be a cashier in a retail setting or an accounts department in a larger organization. It's important for the person handling the transaction to ensure that a receipt is generated at the time of payment.

Can a Cash Receipt form be modified after it's issued?

Once a Cash Receipt form has been issued, it should generally remain unchanged. Modifications can create confusion and reduce accountability. However, if there is a genuine error, it’s advisable to create an amended receipt and note the changes rather than altering the original document. Keeping accurate records is essential for maintaining trust.