What is the purpose of the Cash Drawer Count Sheet form?

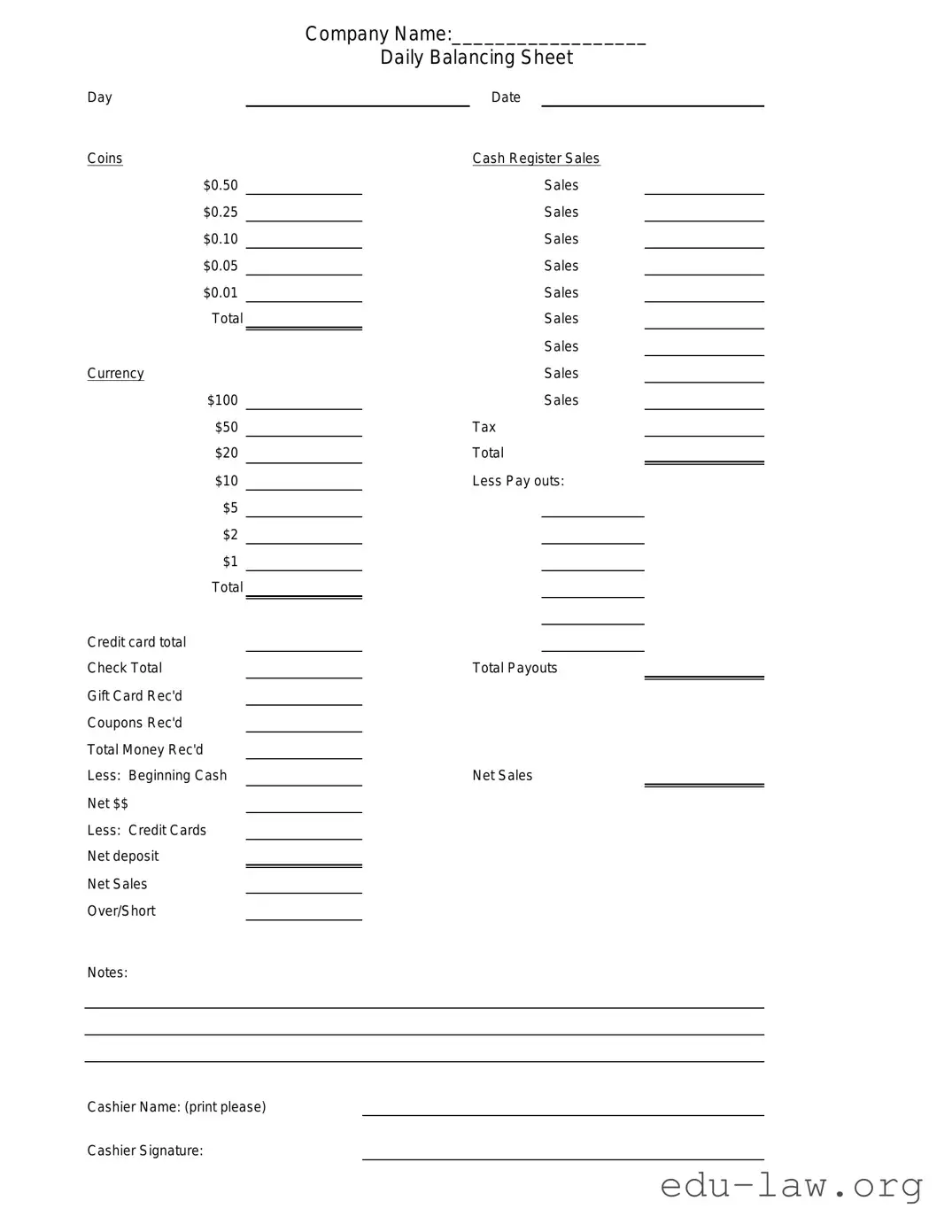

The Cash Drawer Count Sheet form is used to accurately record the cash balance in a cash drawer at the end of a business day or shift. This helps ensure accountability and provides a clear record for financial tracking and auditing purposes.

Who is responsible for completing the Cash Drawer Count Sheet?

The individual handling the cash drawer, typically the cashier or manager, is responsible for completing the Cash Drawer Count Sheet. Accurate completion relies on the person being detail-oriented and following company procedures.

What information should be included on the Cash Drawer Count Sheet?

The sheet should include the date, the name of the individual completing the count, the starting cash balance, the total sales made, and a breakdown of cash received. Any discrepancies should also be noted for review.

How often should the Cash Drawer Count Sheet be filled out?

The Cash Drawer Count Sheet should be completed at the end of each shift or business day. Regular counts help identify patterns in cash flow and any potential issues more quickly, making it easier to maintain accuracy.

What should be done if there is a discrepancy in the cash count?

If a discrepancy is found, it should be documented immediately on the form. The person responsible should investigate further to determine the cause, whether it is a recording error, theft, or another issue. This should also be reported to a supervisor as soon as possible.

Can the Cash Drawer Count Sheet be used for other forms of payment?

While primarily designed for cash, the Cash Drawer Count Sheet can also include information regarding other payment methods, such as credit and debit transactions. However, it's crucial to indicate any cash amounts separately.

How long should the Cash Drawer Count Sheet be kept on file?

Generally, businesses should keep completed Cash Drawer Count Sheets for a specific period defined by their accounting policies, often between three to seven years. This retention ensures compliance with financial regulations and provides a historical record if needed for audits.

Is there a standard format for the Cash Drawer Count Sheet?

Although formats may vary by business, a standard Cash Drawer Count Sheet typically includes sections for date, cashier name, cash amounts, total sales, and any notes. It's essential that the form is easy to read and understand to facilitate accurate records.

What training is needed to correctly fill out the Cash Drawer Count Sheet?

Training should cover how to handle cash, the importance of accuracy in financial reporting, and proper methods for filling out the Cash Drawer Count Sheet. Employees should also be informed about company protocols for managing discrepancies and documentation.