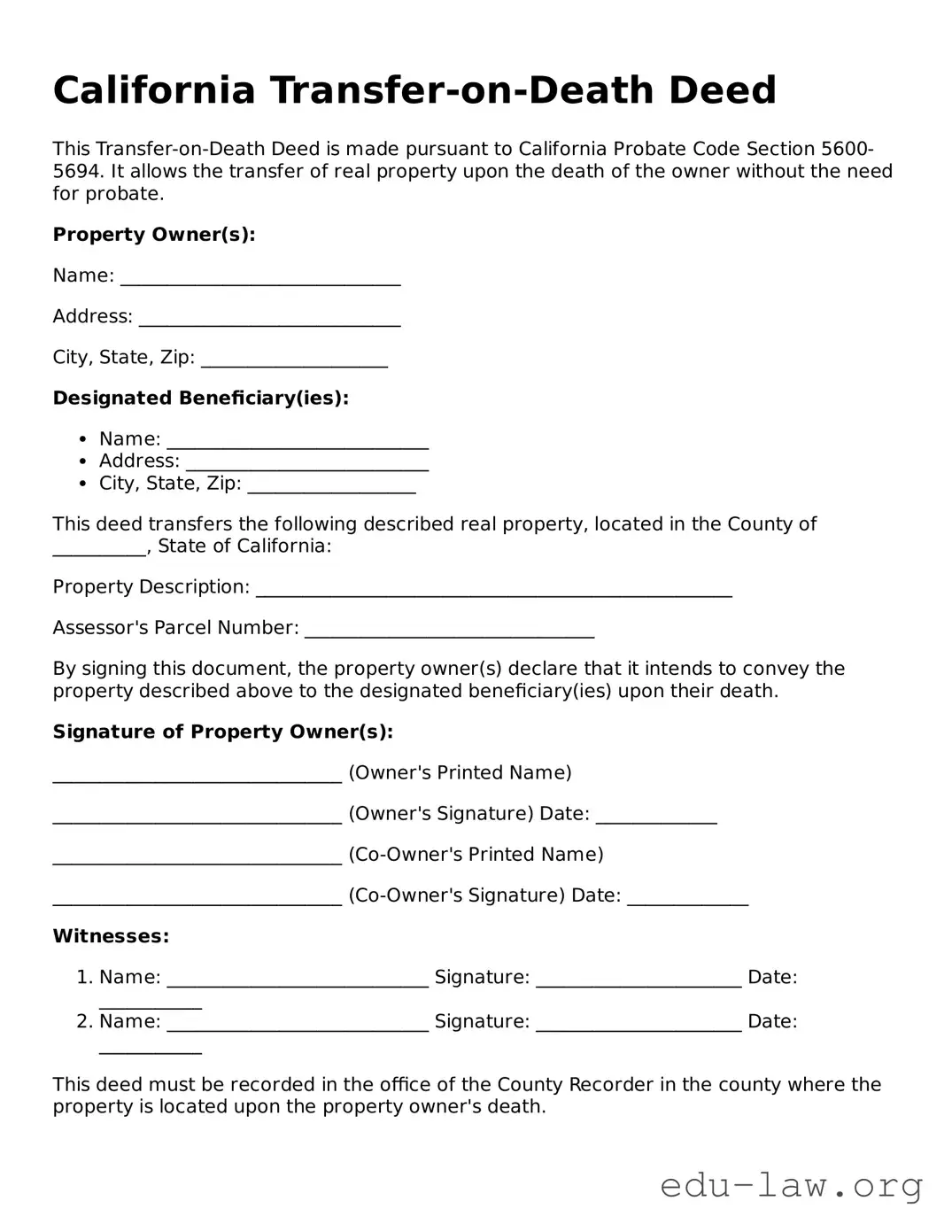

California Transfer-on-Death Deed

This Transfer-on-Death Deed is made pursuant to California Probate Code Section 5600-5694. It allows the transfer of real property upon the death of the owner without the need for probate.

Property Owner(s):

Name: ______________________________

Address: ____________________________

City, State, Zip: ____________________

Designated Beneficiary(ies):

- Name: ____________________________

- Address: __________________________

- City, State, Zip: __________________

This deed transfers the following described real property, located in the County of __________, State of California:

Property Description: ___________________________________________________

Assessor's Parcel Number: _______________________________

By signing this document, the property owner(s) declare that it intends to convey the property described above to the designated beneficiary(ies) upon their death.

Signature of Property Owner(s):

_______________________________ (Owner's Printed Name)

_______________________________ (Owner's Signature) Date: _____________

_______________________________ (Co-Owner's Printed Name)

_______________________________ (Co-Owner's Signature) Date: _____________

Witnesses:

- Name: ____________________________ Signature: ______________________ Date: ___________

- Name: ____________________________ Signature: ______________________ Date: ___________

This deed must be recorded in the office of the County Recorder in the county where the property is located upon the property owner's death.