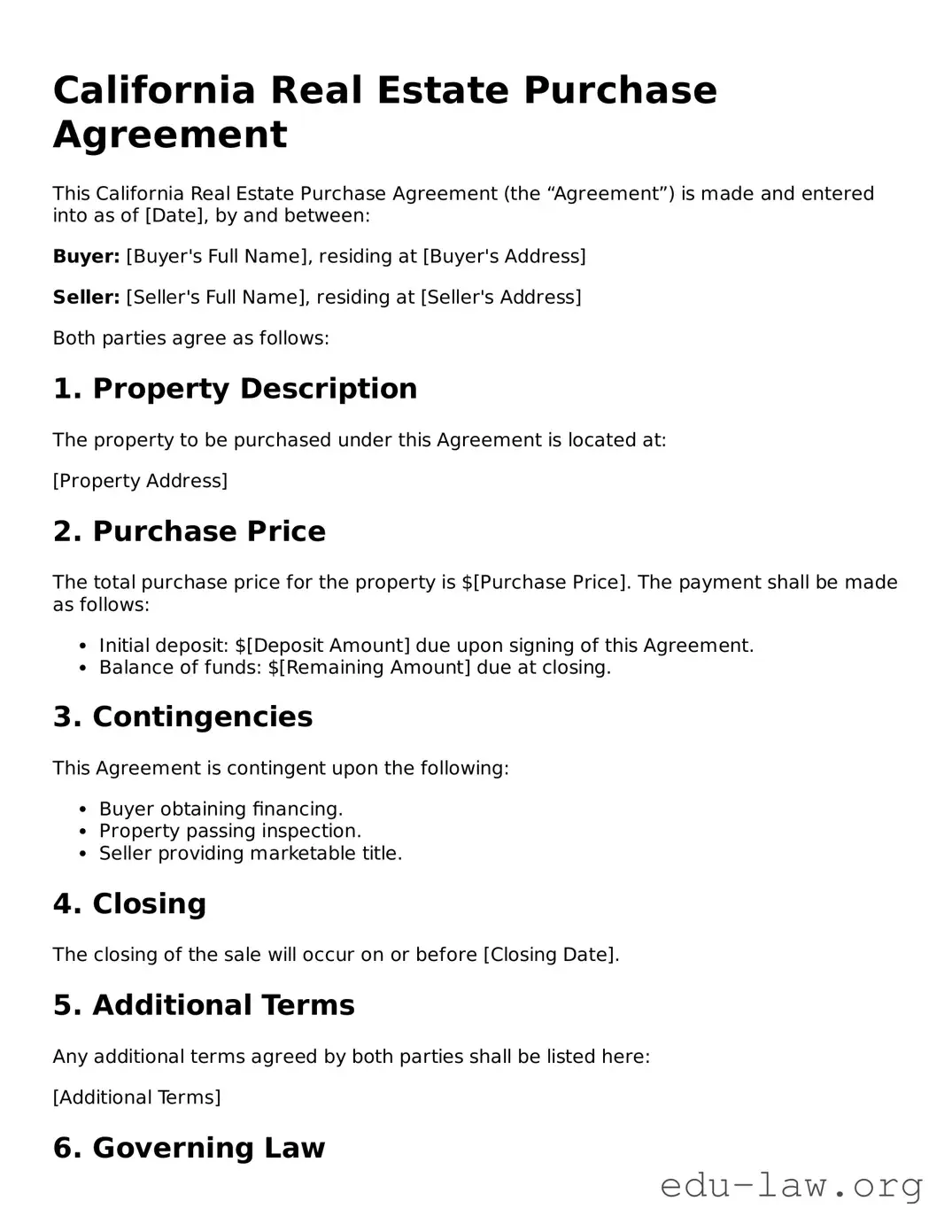

California Real Estate Purchase Agreement

This California Real Estate Purchase Agreement (the “Agreement”) is made and entered into as of [Date], by and between:

Buyer: [Buyer's Full Name], residing at [Buyer's Address]

Seller: [Seller's Full Name], residing at [Seller's Address]

Both parties agree as follows:

1. Property Description

The property to be purchased under this Agreement is located at:

[Property Address]

2. Purchase Price

The total purchase price for the property is $[Purchase Price]. The payment shall be made as follows:

- Initial deposit: $[Deposit Amount] due upon signing of this Agreement.

- Balance of funds: $[Remaining Amount] due at closing.

3. Contingencies

This Agreement is contingent upon the following:

- Buyer obtaining financing.

- Property passing inspection.

- Seller providing marketable title.

4. Closing

The closing of the sale will occur on or before [Closing Date].

5. Additional Terms

Any additional terms agreed by both parties shall be listed here:

[Additional Terms]

6. Governing Law

This Agreement shall be governed by the laws of the State of California.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Buyer Signature: ___________________________ Date: ______________

Seller Signature: __________________________ Date: ______________