What is a Quitclaim Deed in California?

A Quitclaim Deed is a legal document used to transfer an individual's interest in a property to another person without making any guarantees about the title. In California, this deed is particularly useful for situations where the parties know each other, such as between family members or in divorce settlements. It can effectively transfer ownership rights, but it does not protect the buyer from any existing claims or liens on the property.

Who typically uses a Quitclaim Deed?

Quitclaim Deeds are often employed in various scenarios. Common uses include passing property between family members, resolving property disputes, and transferring assets in estate settlements. In addition, they can serve in marriage or divorce transitions, where one spouse transfers their interest in shared property to the other.

What information does a Quitclaim Deed need to include?

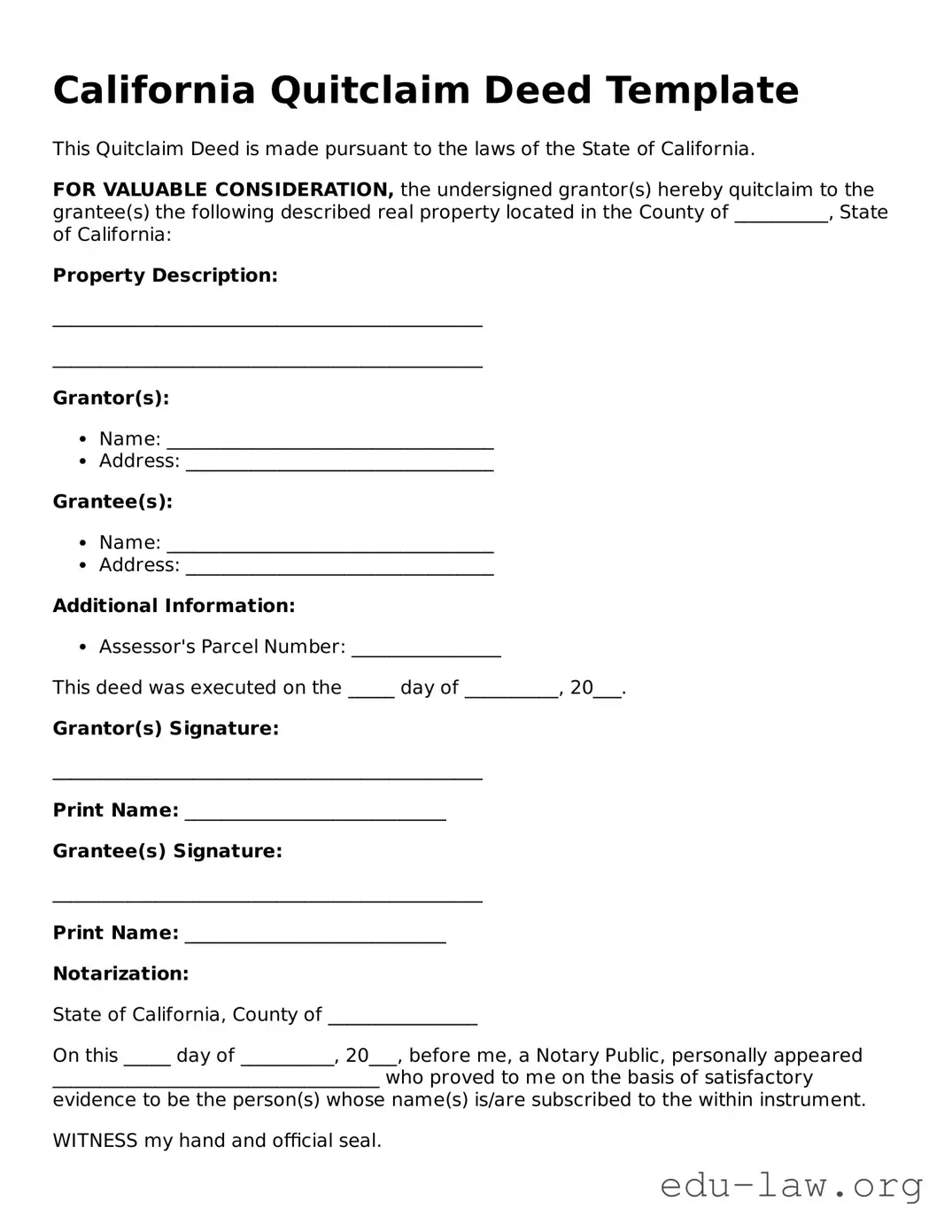

A Quitclaim Deed must contain specific details to be valid. Essential information includes the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property). The property must be adequately described, typically with a legal description of the land. Furthermore, the document should be signed by the grantor and notarized to ensure its legitimacy.

Can I use a Quitclaim Deed to remove someone from a title?

Yes, you can use a Quitclaim Deed to remove someone from a title. If one co-owner wishes to relinquish their ownership interest in the property, they can execute a Quitclaim Deed to the remaining owner. However, the outgoing owner will not be held liable for any obligations that may arise thereafter regarding the property.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. The key difference lies in the guarantees provided. A Warranty Deed offers a guarantee that the grantor has a valid title and the right to transfer it, protecting the grantee against any claims. In contrast, a Quitclaim Deed carries no such assurances. Therefore, individuals should evaluate their needs carefully before choosing which type of deed to use.

Do I need to file the Quitclaim Deed with the county?

Yes, after signing and notarizing the Quitclaim Deed, it must be filed with the county recorder’s office where the property is located. Filing serves as public notice of the transfer and updates the official property records. It is essential to complete this step to ensure that the grantee's ownership rights are recognized legally.

Are there any potential drawbacks to using a Quitclaim Deed?

Using a Quitclaim Deed carries certain risks. One significant drawback is the lack of warranty on the title. If there are any unresolved issues regarding the property—such as liens, mortgages, or disputes—these may impact the grantee negatively. Additionally, once the Quitclaim Deed is executed and recorded, the grantor cannot rescind the transfer without the grantee's consent.

How is a Quitclaim Deed different in California compared to other states?

While Quitclaim Deeds generally follow similar principles across the United States, specific laws and regulations may vary by state. In California, understanding local requirements and procedures is crucial. For example, California mandates that certain forms of documentation, such as preliminary change of ownership reports, may accompany the deed when filed. Always check state-specific regulations to ensure compliance.

Can I create my own Quitclaim Deed?

While you can draft your own Quitclaim Deed, it’s advisable to seek legal guidance or use a template that conforms to California's requirements. Ensuring that the document includes all necessary information and meets legal standards can help avoid future disputes or complications. Many individuals opt to work with legal professionals to guarantee that the deed is properly executed and filed.