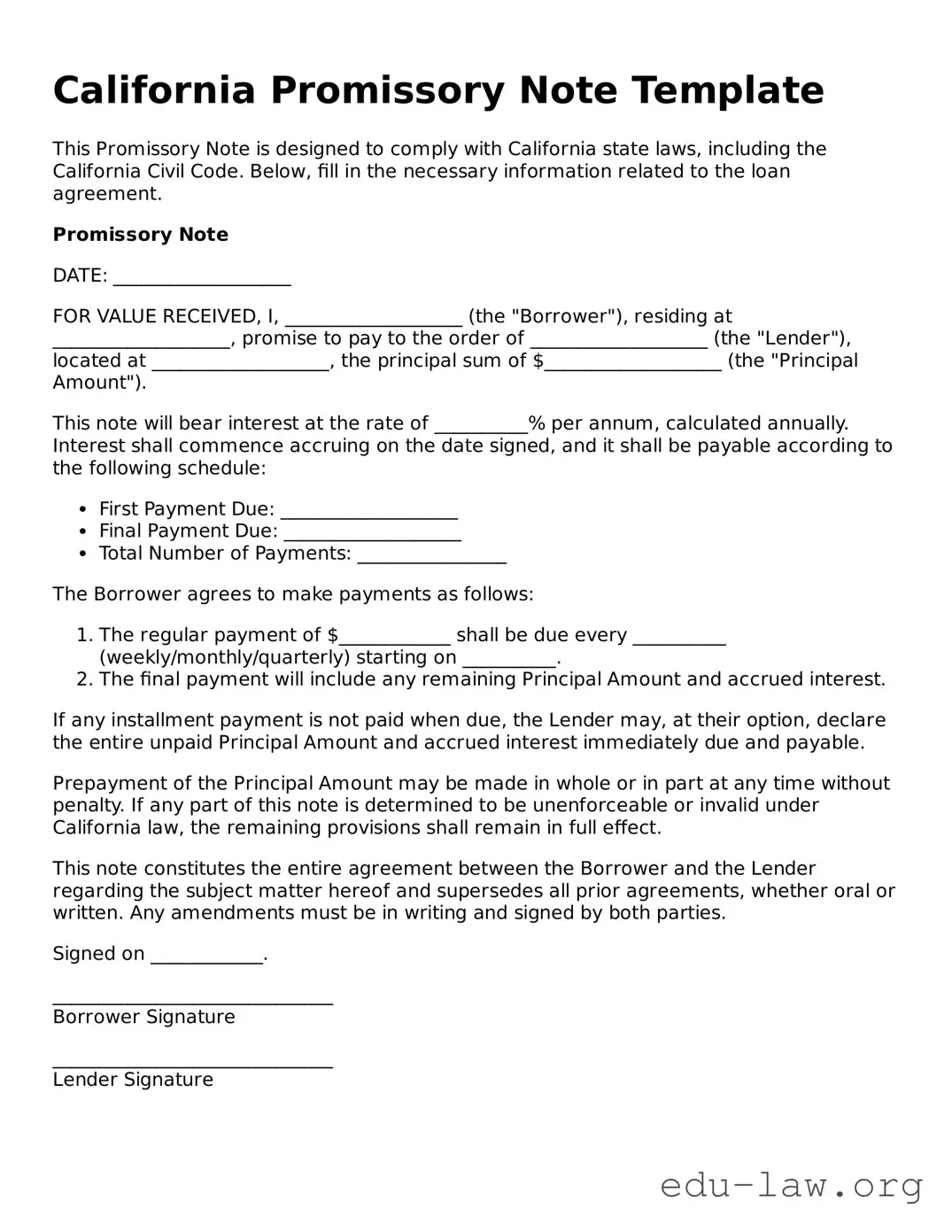

California Promissory Note Template

This Promissory Note is designed to comply with California state laws, including the California Civil Code. Below, fill in the necessary information related to the loan agreement.

Promissory Note

DATE: ___________________

FOR VALUE RECEIVED, I, ___________________ (the "Borrower"), residing at ___________________, promise to pay to the order of ___________________ (the "Lender"), located at ___________________, the principal sum of $___________________ (the "Principal Amount").

This note will bear interest at the rate of __________% per annum, calculated annually. Interest shall commence accruing on the date signed, and it shall be payable according to the following schedule:

- First Payment Due: ___________________

- Final Payment Due: ___________________

- Total Number of Payments: ________________

The Borrower agrees to make payments as follows:

- The regular payment of $____________ shall be due every __________ (weekly/monthly/quarterly) starting on __________.

- The final payment will include any remaining Principal Amount and accrued interest.

If any installment payment is not paid when due, the Lender may, at their option, declare the entire unpaid Principal Amount and accrued interest immediately due and payable.

Prepayment of the Principal Amount may be made in whole or in part at any time without penalty. If any part of this note is determined to be unenforceable or invalid under California law, the remaining provisions shall remain in full effect.

This note constitutes the entire agreement between the Borrower and the Lender regarding the subject matter hereof and supersedes all prior agreements, whether oral or written. Any amendments must be in writing and signed by both parties.

Signed on ____________.

______________________________

Borrower Signature

______________________________

Lender Signature