What is a California Power of Attorney?

A California Power of Attorney is a legal document that allows one person to designate another person to act on their behalf in financial or health-related matters. The person giving authority is known as the principal, while the person receiving authority is known as the agent or attorney-in-fact. This document is important for ensuring that someone you trust can make decisions for you when you are unable to do so yourself.

Why should I consider creating a Power of Attorney?

Creating a Power of Attorney can provide peace of mind. It ensures that your personal affairs and finances are managed according to your wishes in case of incapacitation. Additionally, it helps avoid potential conflicts among family members, as it clearly outlines who has the authority to make decisions on your behalf.

What types of Power of Attorney are available in California?

In California, there are primarily two types of Power of Attorney: financial and healthcare. A financial Power of Attorney allows your agent to handle your financial matters, such as paying bills and managing investments. A healthcare Power of Attorney, on the other hand, gives your agent the authority to make medical decisions if you are unable to communicate your wishes.

Do I need to have a lawyer to create a Power of Attorney?

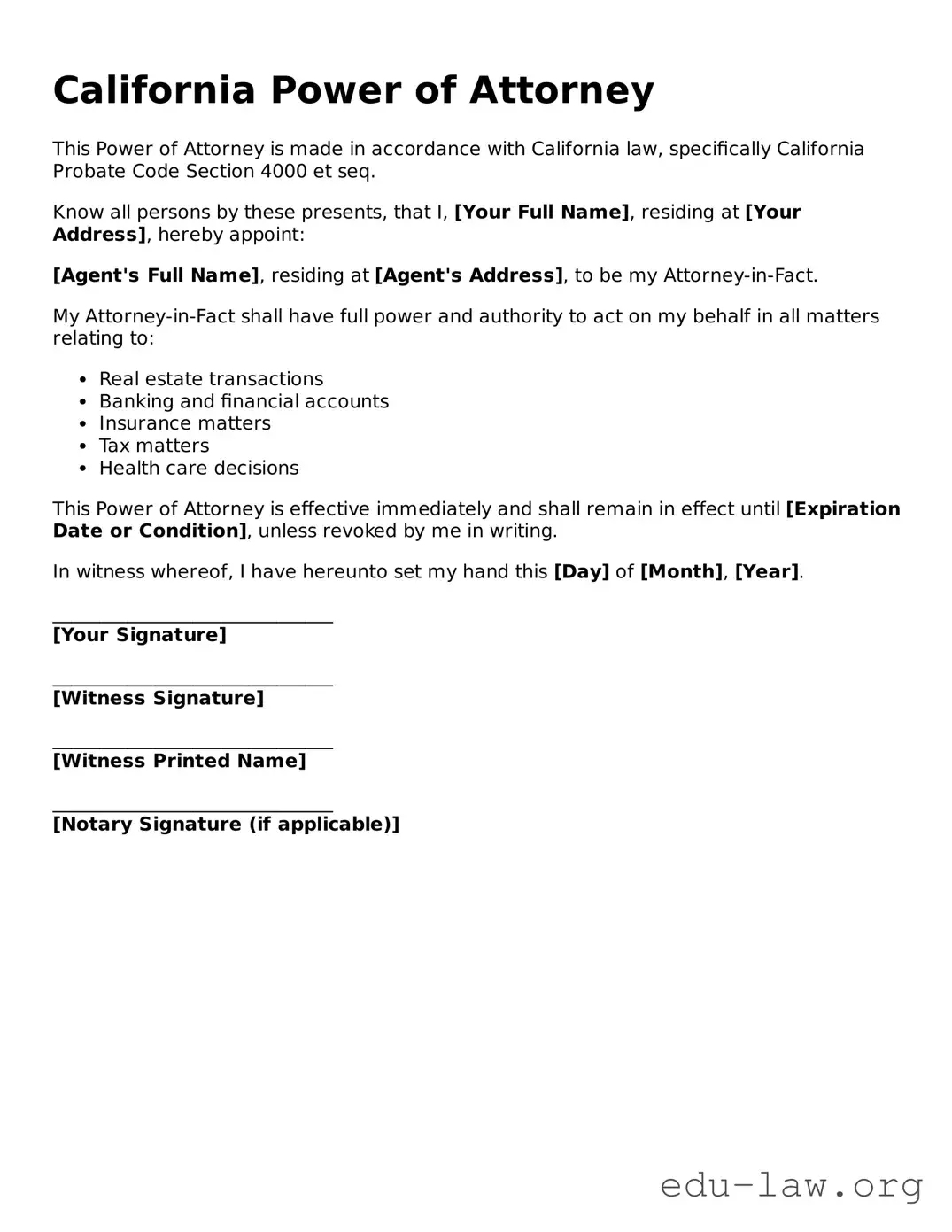

No, you do not necessarily need a lawyer to create a Power of Attorney in California. However, it can be beneficial to seek legal advice, especially if your situation is complex. There are templates available online that you can follow, but ensure they comply with California’s specific requirements.

What are the requirements for a valid Power of Attorney in California?

For a Power of Attorney to be valid in California, it must be signed by the principal and dated. The signature may need to be notarized or witnessed, depending on the type of Power of Attorney. For financial matters, a notary is often required. It's essential to follow the correct procedures to ensure that the document is enforceable.

Can I revoke a Power of Attorney once it has been created?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To revoke it, you should create a written revocation document and inform your agent and any relevant parties of the change. It’s wise to also retrieve any copies of the original Power of Attorney from those who had it.

What happens if I do not have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, your family may need to go through the court to have a conservator appointed to manage your affairs. This process can be time-consuming, costly, and emotionally taxing for all involved. Having a Power of Attorney avoids these complications and allows you to make your preferences clear.

Is there a fee for creating a Power of Attorney in California?

The fee for creating a Power of Attorney can vary. If you choose to work with an attorney, you may incur legal fees based on their rates. Alternatively, if you use a template or online service, the costs may be minimal or even free. Make sure to consider the complexity of your situation when determining if legal assistance is necessary.