What is a California Operating Agreement?

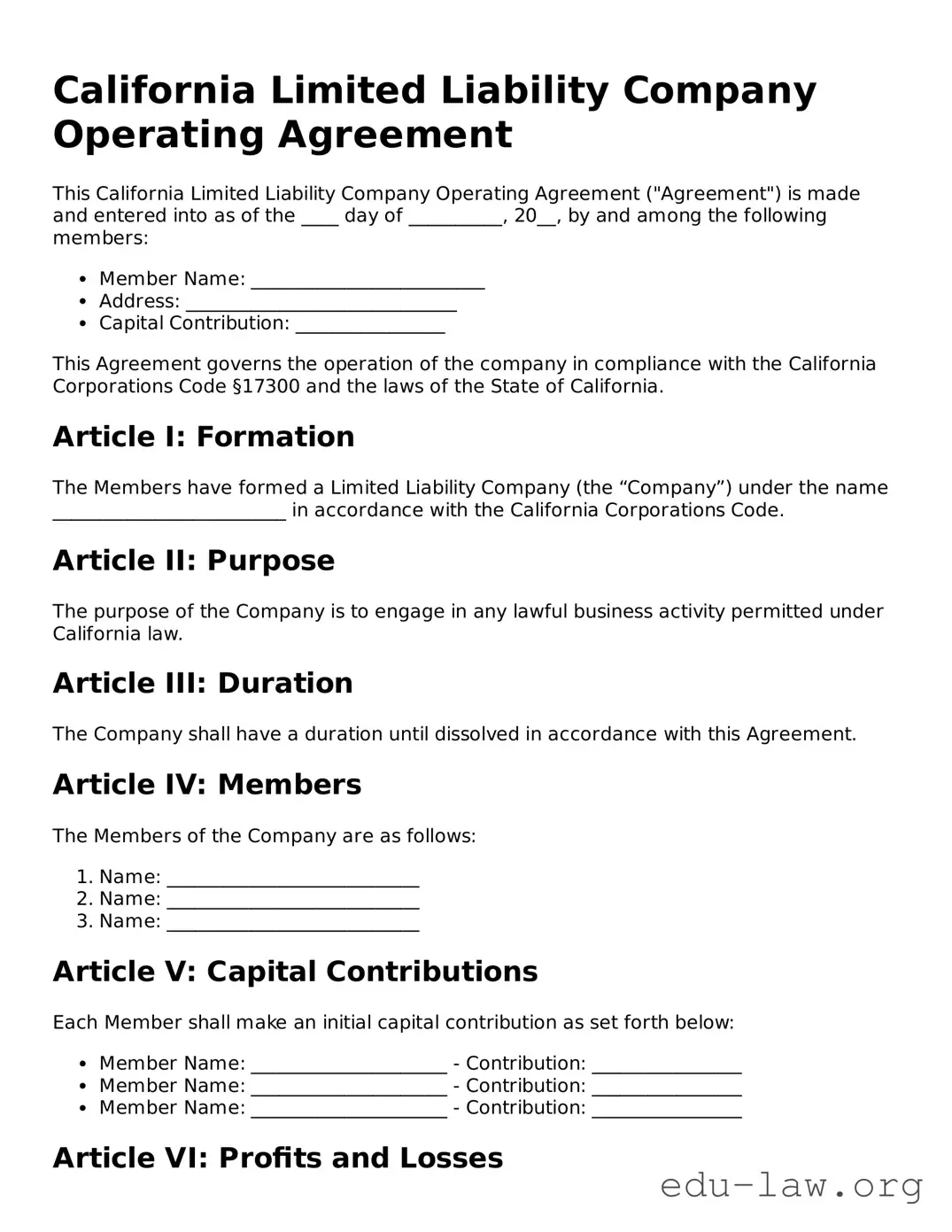

A California Operating Agreement is a legal document that outlines the rules and regulations for managing a limited liability company (LLC). It specifies the roles of members, management structure, and operational procedures. This agreement is essential for clarifying the rights and responsibilities of all parties involved.

Is an Operating Agreement required in California?

While California does not legally require LLCs to have an Operating Agreement, it is highly recommended. Having one helps establish clear guidelines and can protect members in case of disputes. It also provides credibility to the business if you need to open a bank account or get loans.

What should be included in a California Operating Agreement?

A comprehensive Operating Agreement should include details such as the LLC's name, purpose, member contributions, voting rights, distribution of profits and losses, management structure, and procedures for adding new members or handling member departures.

Can I create my own Operating Agreement?

Yes, you can draft your own Operating Agreement. Many templates are available online, but it’s important to ensure that it meets California laws. Customizing the agreement to fit your business needs is always a good idea.

How do I amend an Operating Agreement?

To amend an Operating Agreement, members must follow the procedure outlined in the existing document. Generally, this involves getting unanimous or majority agreement from all members. Once agreed upon, the amendment should be documented and signed.

Does an Operating Agreement need to be filed with the state?

No, the Operating Agreement does not need to be filed with the state of California. However, keeping it in your records is essential. It should be accessible to all members in case of disputes or questions.

What happens if I don’t have an Operating Agreement?

Without an Operating Agreement, California LLCs default to state laws for management and operations. This can lead to ambiguous rules and greater risk of disputes among members. It may also leave your business vulnerable to unexpected challenges.

How can an Operating Agreement protect me?

An Operating Agreement can help protect your personal assets. By clearly outlining the separation between personal and business matters, it reinforces the limited liability status of your LLC. It can also provide a framework for resolving disputes among members.

Can an Operating Agreement be used in court?

Yes, an Operating Agreement can be used in court if a dispute arises. It serves as a record of the agreed-upon terms and conditions. If a member violates the agreement, it can be enforced in a legal setting, ensuring that all parties adhere to the specified guidelines.

Is it necessary to have an attorney review my Operating Agreement?

While it is not strictly necessary to have an attorney review your Operating Agreement, it is a wise choice. An attorney can ensure that the document complies with state laws and addresses all necessary concerns effectively, providing peace of mind for all members.