What is a Gift Deed in California?

A Gift Deed is a legal document used to transfer property ownership from one person to another without the exchange of money. In California, this document outlines that the property owner (the grantor) voluntarily gives the property to another person (the grantee) as a gift. This deed helps clarify the transfer of ownership and ensures that the recipient has clear title to the property.

Who can use a Gift Deed?

Anyone who owns property in California can use a Gift Deed to transfer that property to another person. This can include individuals, spouses, or family members wishing to pass on property without monetary consideration. However, it is important to ensure that the property is not subject to any liens or mortgages that could complicate the transfer.

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when using a Gift Deed. While the grantor may not owe income taxes on the gift itself, the transaction may be subject to gift tax rules set by the IRS. If the value of the gift exceeds the annual exclusion limit, the grantor may need to file a gift tax return. Additionally, using a Gift Deed can impact property tax assessments, so it’s wise to consult a tax advisor for specific guidance.

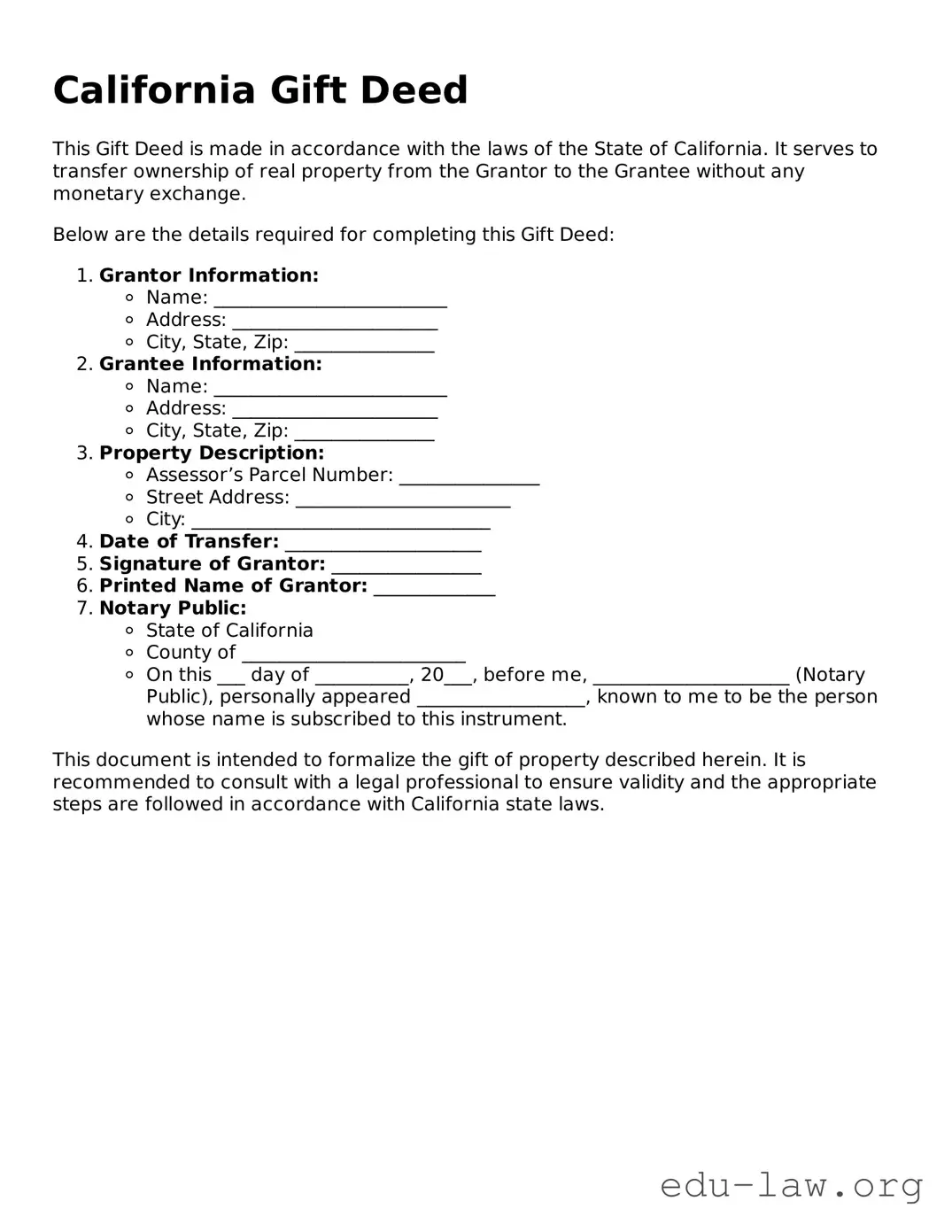

What information is needed to fill out a Gift Deed?

To complete a Gift Deed, you will need the property description, including the address and legal description from the title. Both the grantor and grantee's names and contact information are essential. Additionally, you should include the date of the gift and any terms or conditions, if applicable. A notary public must witness the signing to make the deed legally binding.

Do I need an attorney to create a Gift Deed?

While it is not legally required to have an attorney assist in creating a Gift Deed, it can be beneficial. An attorney can provide expert advice to ensure that the deed complies with all state laws and accurately reflects your intentions. If complex issues arise, such as questions about liens or tax implications, legal assistance becomes invaluable.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it usually cannot be revoked. This is because a gift, by nature, is an irrevocable transfer of property. However, if the grantor had a valid reason, like incompetence at the time of the transfer or a failure to meet legal requirements, there could be grounds to challenge the deed in court. It’s prudent to be sure of your decision before proceeding with a gift.

What happens if the grantor dies after signing a Gift Deed?

If the grantor dies after signing a Gift Deed but before the deed is recorded, the deed may still be valid, depending on California law and specific circumstances. If the deed was recorded before the grantor's death, the transfer is typically considered complete. It becomes essential to consult with a legal expert in estate planning to navigate any complexities that may arise during probate.

How do I record a Gift Deed in California?

To record a Gift Deed in California, the completed and notarized deed must be submitted to the county recorder’s office where the property is located. There may be a small fee for recording, and it is advisable to provide a copy for your records. Once recorded, the Gift Deed becomes part of the public record, establishing the grantee as the new owner of the property.