What is a Durable Power of Attorney in California?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint someone else, called the agent, to make decisions on their behalf. This arrangement remains in effect even if the principal becomes incapacitated. The DPOA can cover a variety of matters, including financial, legal, and healthcare decisions, depending on the preferences outlined in the document.

Who can be appointed as an agent in a Durable Power of Attorney?

In California, any competent adult can be chosen as an agent. This could be a family member, a friend, or a trusted advisor. It’s important that the selected agent is someone who is responsible and trustworthy, as they will have significant authority to manage the principal's affairs.

How does a Durable Power of Attorney become effective?

A DPOA can become effective immediately upon signing or at a later date, as specified by the principal. If it is set to become effective upon the principal's incapacitation, a determination of incapacity must be made by a qualified healthcare professional to trigger its activation.

What is the difference between a Durable Power of Attorney and a standard Power of Attorney?

The primary difference lies in the durability aspect. A standard Power of Attorney typically becomes invalid if the principal becomes incapacitated, while a Durable Power of Attorney remains effective under such circumstances. This distinction ensures that the agent can continue to act on the principal's behalf when they are unable to do so themselves.

Can a Durable Power of Attorney be revoked?

Yes, a Durable Power of Attorney can be revoked at any time by the principal, as long as they are still competent. To revoke a DPOA, the principal should notify the agent in writing and formally execute a revocation document. It is advisable to also notify institutions or individuals that were relying on the original DPOA.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to hire a lawyer to draft a DPOA, it may be beneficial to do so, especially if the principal's financial situation is complex or if there are specific wishes that need to be clearly communicated. Utilizing a lawyer ensures the document meets all legal requirements and accurately reflects the principal's intentions.

Is it necessary to notarize a Durable Power of Attorney in California?

In California, a Durable Power of Attorney does not require notarization to be valid. However, having the document notarized can help in proving its authenticity and may be required by certain financial institutions or entities when it is presented for use.

What happens if I don’t have a Durable Power of Attorney?

If an individual becomes incapacitated without a Durable Power of Attorney in place, family members may face a lengthy and often expensive legal process to establish guardianship or conservatorship. This court intervention can be avoided by having a DPOA prepared in advance, allowing for smoother management of the principal's affairs.

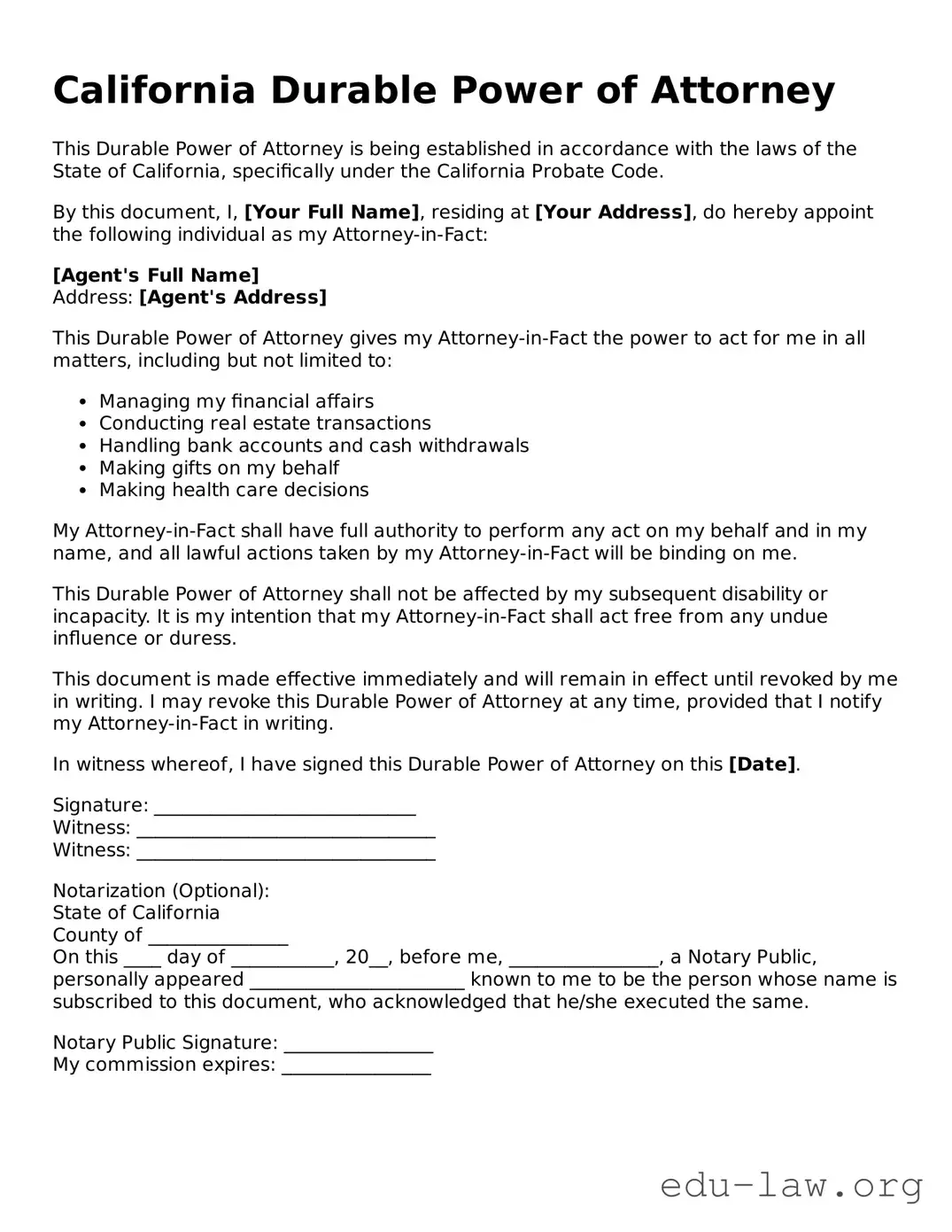

Are there any specific requirements for completing a Durable Power of Attorney in California?

Yes, certain requirements must be met to complete a Durable Power of Attorney in California. The document must be signed by the principal in the presence of one witness or by a notary public. Additionally, the agent must not be the only witness. The principal should also make it clear that the document is intended to be durable, ensuring that it remains effective even if they become incapacitated.