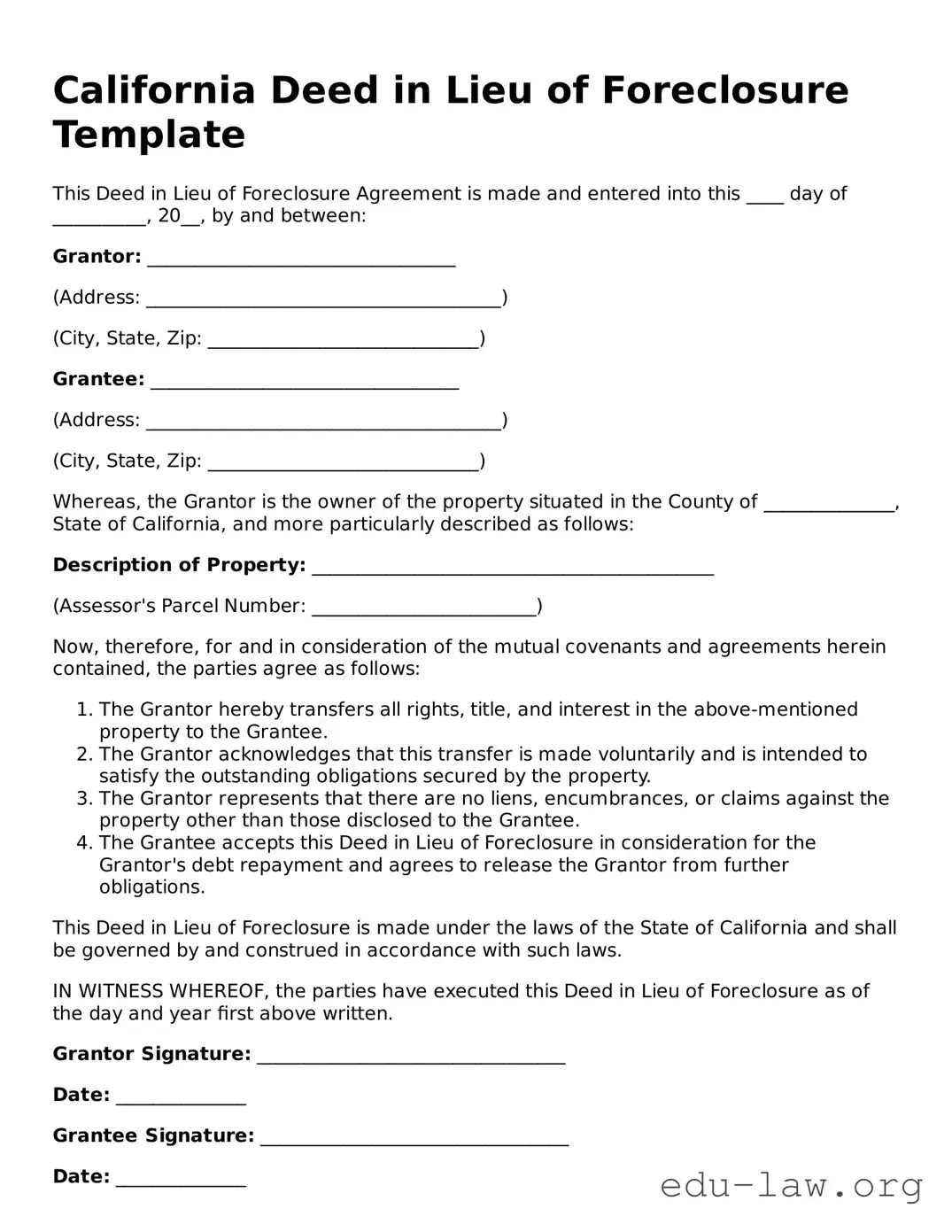

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure Agreement is made and entered into this ____ day of __________, 20__, by and between:

Grantor: _________________________________

(Address: ______________________________________)

(City, State, Zip: _____________________________)

Grantee: _________________________________

(Address: ______________________________________)

(City, State, Zip: _____________________________)

Whereas, the Grantor is the owner of the property situated in the County of ______________, State of California, and more particularly described as follows:

Description of Property: ___________________________________________

(Assessor's Parcel Number: ________________________)

Now, therefore, for and in consideration of the mutual covenants and agreements herein contained, the parties agree as follows:

- The Grantor hereby transfers all rights, title, and interest in the above-mentioned property to the Grantee.

- The Grantor acknowledges that this transfer is made voluntarily and is intended to satisfy the outstanding obligations secured by the property.

- The Grantor represents that there are no liens, encumbrances, or claims against the property other than those disclosed to the Grantee.

- The Grantee accepts this Deed in Lieu of Foreclosure in consideration for the Grantor's debt repayment and agrees to release the Grantor from further obligations.

This Deed in Lieu of Foreclosure is made under the laws of the State of California and shall be governed by and construed in accordance with such laws.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor Signature: _________________________________

Date: ______________

Grantee Signature: _________________________________

Date: ______________

Notary Public:

State of California

County of ______________

On this ____ day of __________, 20__, before me, a Notary Public in and for said county, personally appeared _____________________, known to me to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same.

Witness my hand and official seal.

Notary Public Signature: _________________________________

My Commission Expires: ______________