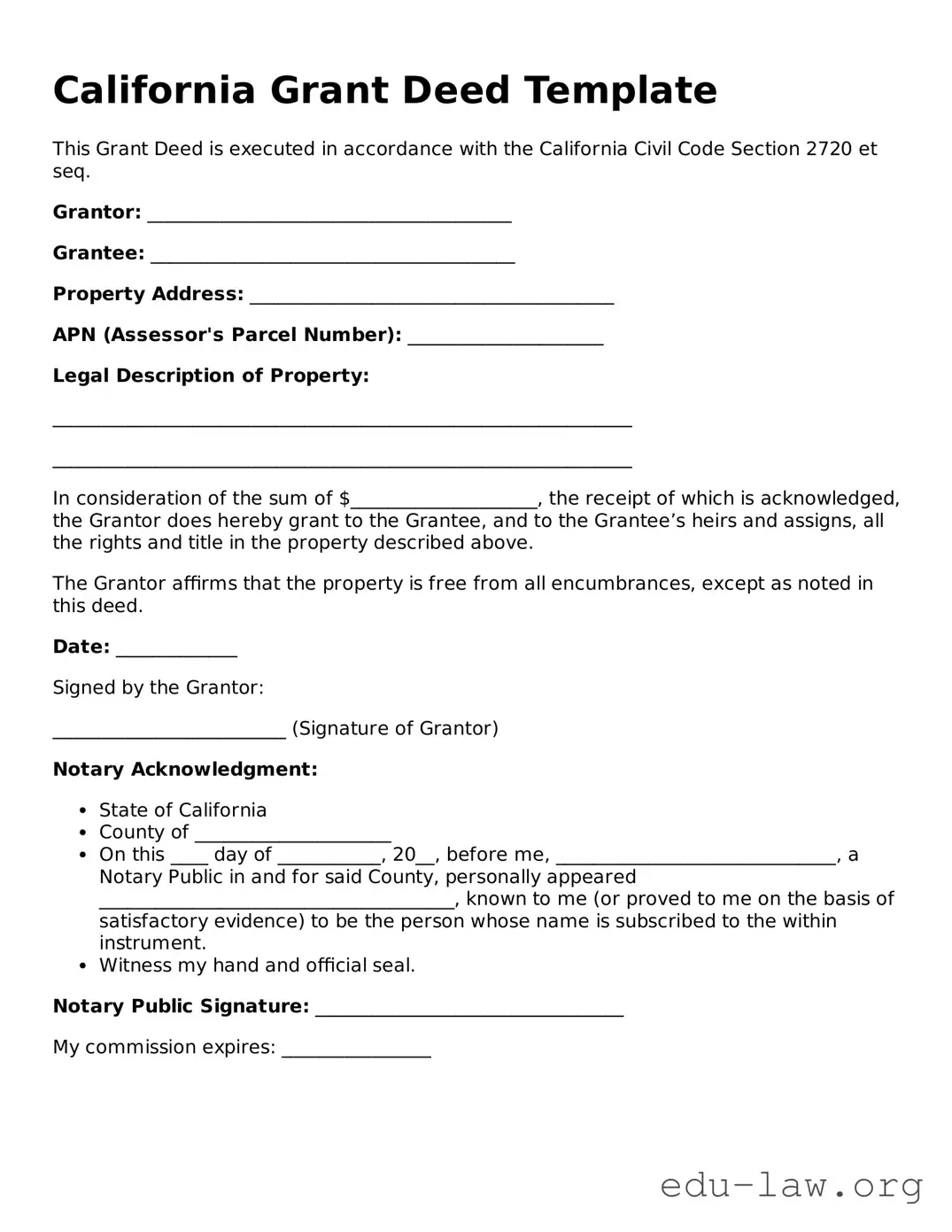

California Grant Deed Template

This Grant Deed is executed in accordance with the California Civil Code Section 2720 et seq.

Grantor: _______________________________________

Grantee: _______________________________________

Property Address: _______________________________________

APN (Assessor's Parcel Number): _____________________

Legal Description of Property:

______________________________________________________________

______________________________________________________________

In consideration of the sum of $____________________, the receipt of which is acknowledged, the Grantor does hereby grant to the Grantee, and to the Grantee’s heirs and assigns, all the rights and title in the property described above.

The Grantor affirms that the property is free from all encumbrances, except as noted in this deed.

Date: _____________

Signed by the Grantor:

_________________________ (Signature of Grantor)

Notary Acknowledgment:

- State of California

- County of _____________________

- On this ____ day of ___________, 20__, before me, ______________________________, a Notary Public in and for said County, personally appeared ______________________________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument.

- Witness my hand and official seal.

Notary Public Signature: _________________________________

My commission expires: ________________