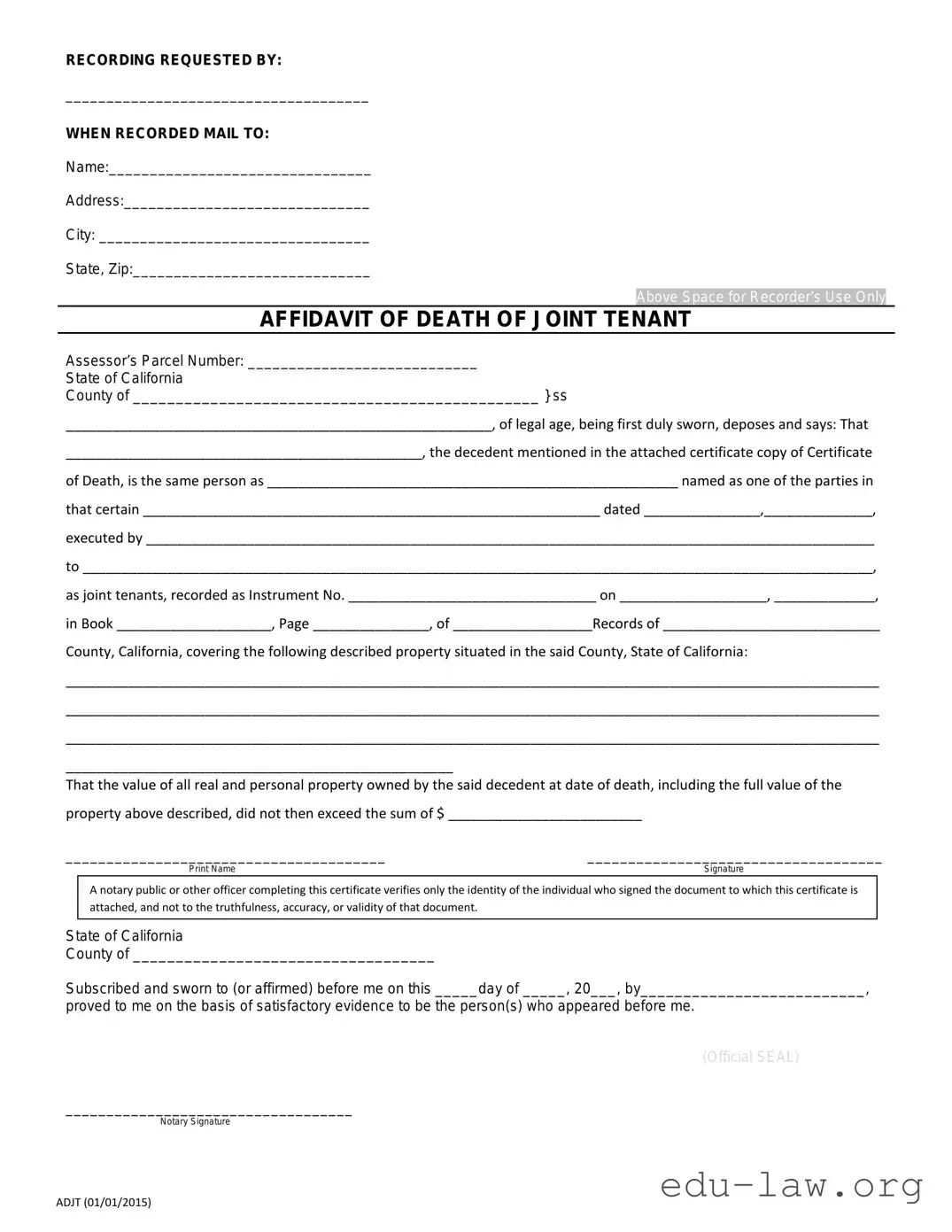

RECORDING REQUESTED BY:

_____________________________________

WHEN RECORDED MAIL TO:

Name:________________________________

Address:______________________________

City: _________________________________

State, Zip:_____________________________

Above Space for Recorder’s Use Only

AFFIDAVIT OF DEATH OF JOINT TENANT

Assessor’s Parcel Number: ____________________________

State of California

County of _______________________________________________ } ss

_______________________________________________________, of legal age, being first duly sworn, deposes and says: That

______________________________________________, the decedent mentioned in the attached certificate copy of Certificate

of Death, is the same person as _____________________________________________________ named as one of the parties in

that certain ___________________________________________________________ dated _______________,______________,

executed by ______________________________________________________________________________________________

to ______________________________________________________________________________________________________,

as joint tenants, recorded as Instrument No. ________________________________ on ___________________, _____________,

in Book ____________________, Page _______________, of __________________Records of ____________________________

County, California, covering the following described property situated in the said County, State of California:

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

__________________________________________________

That the value of all real and personal property owned by the said decedent at date of death, including the full value of the property above described, did not then exceed the sum of $ _________________________

_______________________________________ |

____________________________________ |

Print Name |

Signature |

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the document to which this certificate is attached, and not to the truthfulness, accuracy, or validity of that document.

State of California

County of ___________________________________

Subscribed and sworn to (or affirmed) before me on this _____day of _____, 20___, by__________________________,

proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

(Official SEAL)

___________________________________

Notary Signature