What is a California Bill of Sale?

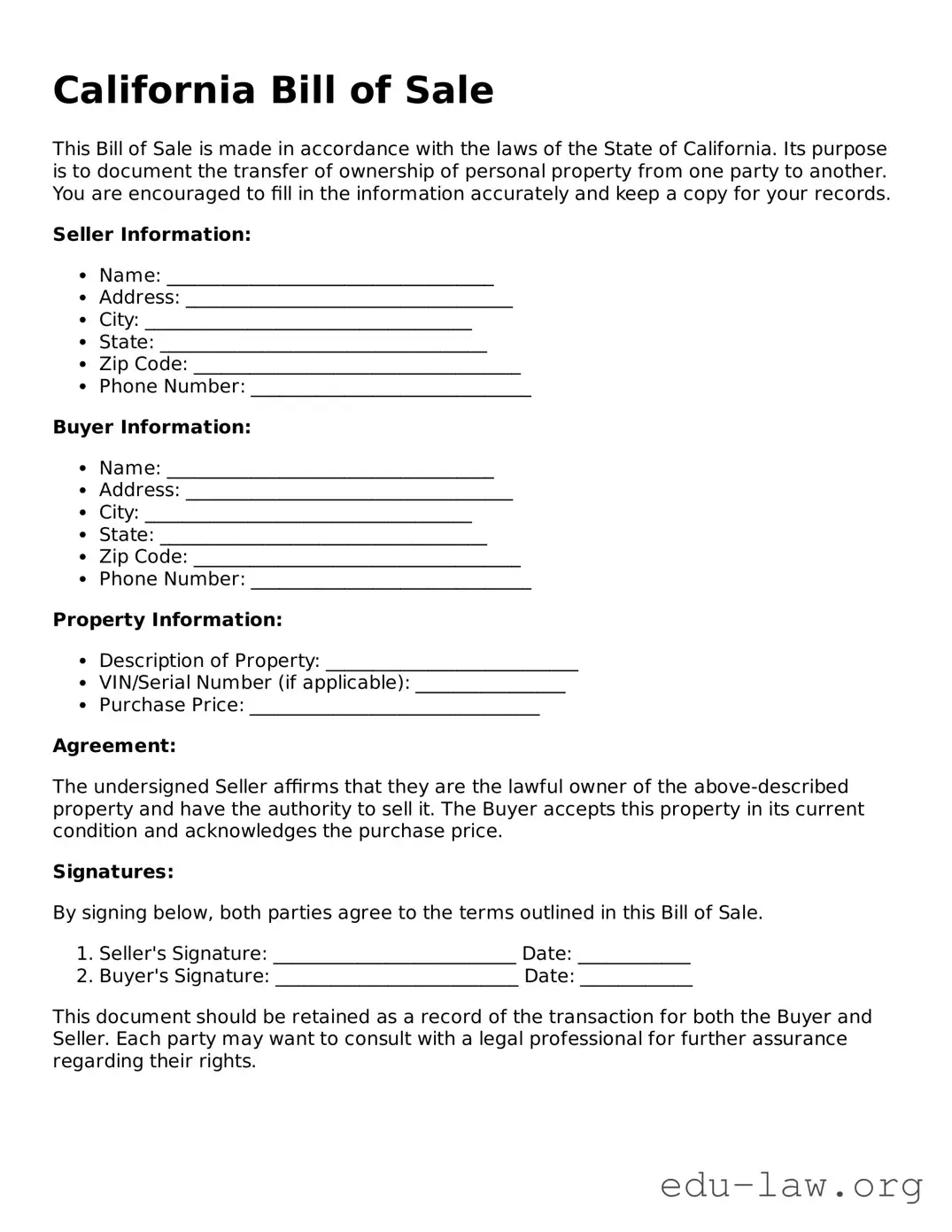

A California Bill of Sale is a legal document that serves as proof of the transfer of ownership from a seller to a buyer. It details the specific item being sold, the names of both parties, and the date of the transaction. This document is often used for vehicles but can apply to other items as well.

Do I need a Bill of Sale for every transaction in California?

Not every transaction requires a Bill of Sale. For example, items like household goods may not need one unless specifically requested by the buyer or seller. However, it is highly recommended for larger transactions, especially for vehicles, to protect both parties involved.

What information should be included in a California Bill of Sale?

The Bill of Sale should include the names and addresses of both the buyer and the seller. It should also describe the item being sold, including any serial numbers or identification details. Additionally, the date of the sale and the sale price should be clearly stated.

Is a Bill of Sale legally binding?

Yes, a Bill of Sale is a legally binding document as long as it includes all necessary information and both parties agree to the terms. It holds significance in the event of disputes over the transaction.

Do I need to have my Bill of Sale notarized?

A notarized Bill of Sale is not typically required in California. However, having it notarized can add an extra layer of protection and validity, particularly in high-value transactions.

Can I create my own Bill of Sale?

Absolutely. You can create your own Bill of Sale using templates available online or by drafting a personalized document. Just make sure it contains all necessary details to ensure it’s effective.

Where can I obtain a Bill of Sale form in California?

You can find Bill of Sale forms at various online resources, including legal websites and government resources. It's also possible to draft your own based on standard templates found online.

Do I need to provide a copy of the Bill of Sale to anyone?

Yes, it’s good practice to provide a copy of the Bill of Sale to both the buyer and seller. This ensures that both parties have proof of the transaction and its details for their records.

What if the item sold is defective or not as described?

If the item sold is defective or not as described, the buyer may have grounds for a dispute. The Bill of Sale can serve as important documentation in these situations, as it outlines the specifics of the sale and responsibilities of each party.

How long should I keep a Bill of Sale?

It is advisable to keep the Bill of Sale as long as you own the item and ideally for at least several years after the sale. This record can be helpful for tax purposes or in case of any future disputes.