What are the Articles of Incorporation in California?

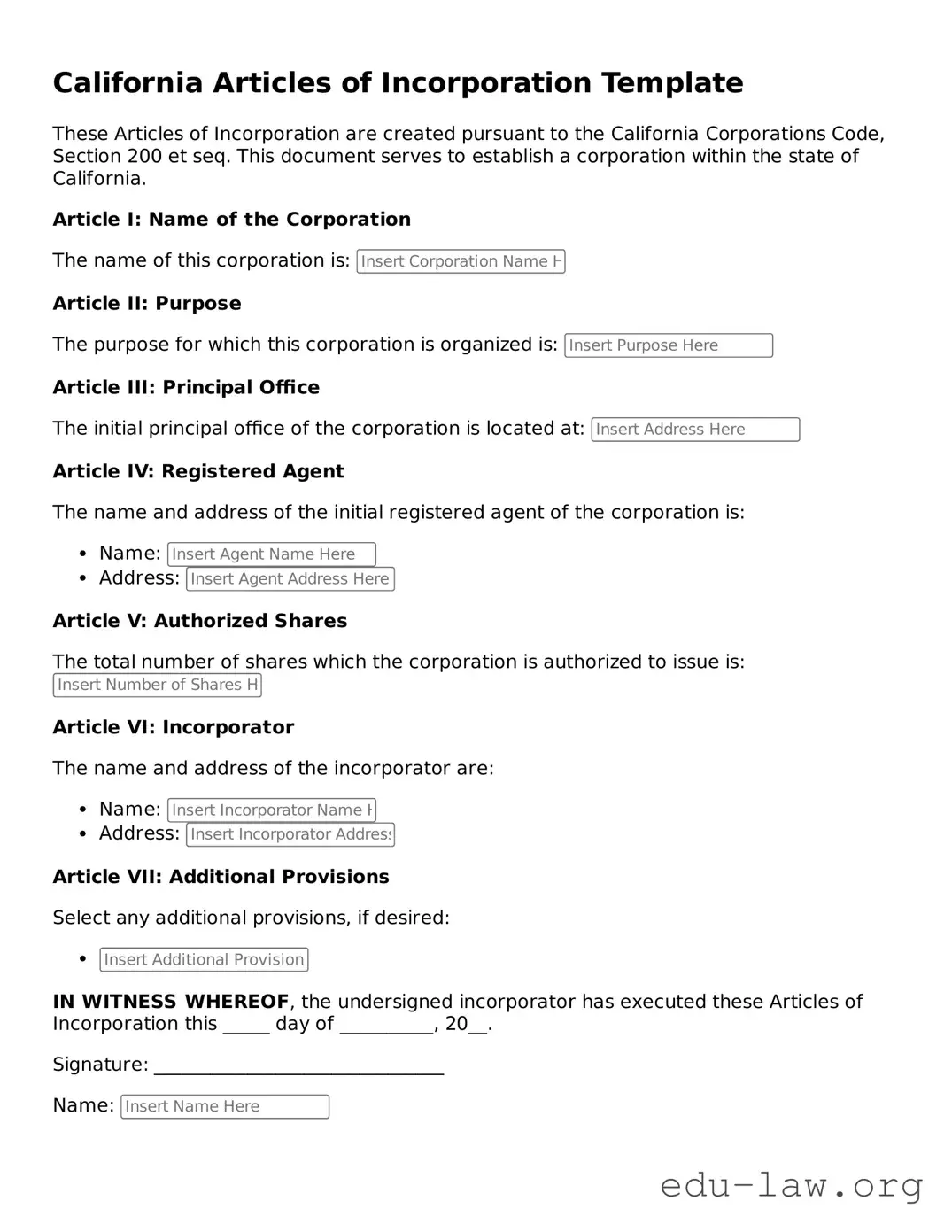

The Articles of Incorporation are a legal document that establishes a corporation in California. This form outlines important information about the corporation, including its name, purpose, registered agent, and the number of shares the corporation is authorized to issue. Filing these articles is a crucial step in starting a corporation in the state.

Who needs to file Articles of Incorporation?

Any individual or group planning to form a corporation in California must file Articles of Incorporation. Whether it’s a nonprofit, a small business, or a larger corporation, this step is essential for legal recognition. It helps to provide a structure for the business and outlines its framework.

What information is required on the Articles of Incorporation form?

The Articles of Incorporation form usually requires the following information: the name of the corporation, its principal office address, the name and address of the initial registered agent, and the purpose of the corporation. Additionally, it includes details about the number of shares the corporation is authorized to issue, if applicable.

How do I file the Articles of Incorporation in California?

To file the Articles of Incorporation, an individual must complete the form and submit it to the California Secretary of State. This can typically be done online, by mail, or in person. Along with the completed form, a filing fee is also required. Make sure to check the current fees and processing times to ensure compliance.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation and any additional services you may choose. Generally, the fee can range from $100 to $150, but it's advisable to check the California Secretary of State's website for the most accurate and up-to-date fee information.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If changes are needed—such as updating the corporate name or changing the registered agent—you will have to file the appropriate amendment form with the California Secretary of State. Amending the articles may incur additional fees.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, it may take anywhere from a few days to several weeks. Expedited services are available for those who need faster processing. Checking the state’s website for current processing times can provide a clearer expectation.

Do I need a lawyer to file my Articles of Incorporation?

While it is not mandatory to hire a lawyer, some individuals choose to do so for guidance and assistance. Filing the Articles of Incorporation can be straightforward, especially with access to resources and forms. However, a lawyer can help ensure compliance with all legal requirements and assist with complex situations.

What happens after my Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, the corporation becomes a legal entity. You will receive a stamped copy from the Secretary of State, which serves as official documentation of the corporation’s existence. After that, you must comply with other obligations, such as obtaining necessary permits and establishing bylaws.