What is a Business Purchase and Sale Agreement?

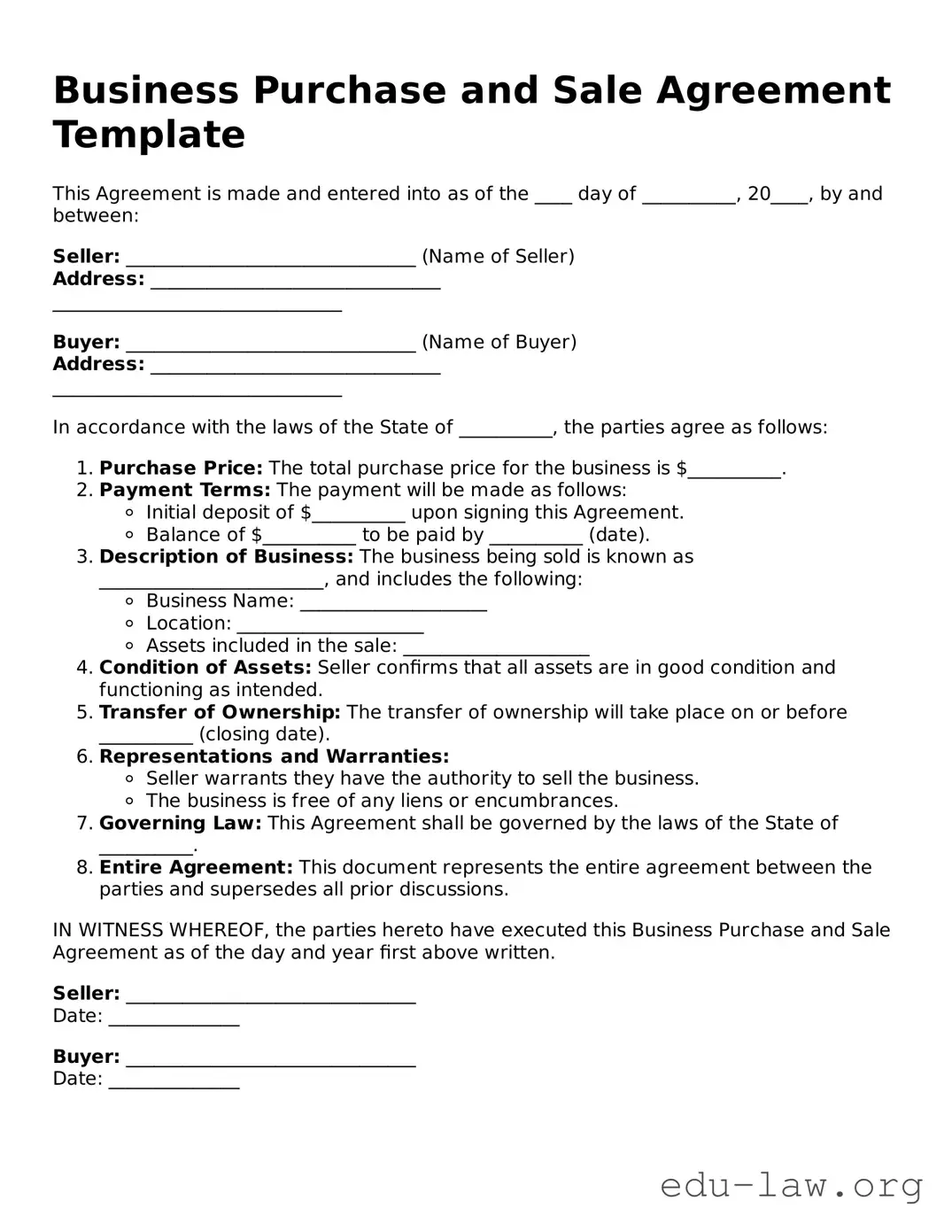

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions associated with the sale of a business. This agreement serves as a roadmap for both the buyer and the seller, detailing the rights, obligations, and expectations of both parties in the transaction. It typically covers aspects such as the purchase price, payment terms, and conditions under which the sale will occur.

Why is a Business Purchase and Sale Agreement important?

This agreement is crucial because it helps to prevent misunderstandings by clearly defining each party's responsibilities. It protects the interests of both the buyer and the seller, ensuring that all parties are on the same page regarding the details of the business transaction. A well-drafted agreement can also minimize disputes and legal complications that may arise later.

What key elements should be included in the agreement?

Several essential elements should be included in the Business Purchase and Sale Agreement. These typically encompass the purchase price, payment structure, description of the business being sold, liabilities being assumed, warranties and representations from both parties, and details about the closing process. Additionally, clauses related to non-compete agreements and confidentiality may also be included to protect sensitive information and future business interests.

Who should prepare the Business Purchase and Sale Agreement?

While it is possible for business owners to draft the agreement themselves, it is generally advisable to consult or work with a professional, such as an attorney or a contract specialist. These professionals can ensure that the document complies with applicable laws and adequately addresses the unique circumstances of the sale. Their expertise can be instrumental in identifying potential pitfalls and ensuring all necessary provisions are included.

How long does it take to complete the agreement?

The time it takes to complete the Business Purchase and Sale Agreement can vary significantly depending on the complexity of the transaction and the efficiency of communication between the parties involved. On average, it may take anywhere from a few days to several weeks to finalize the agreement. Factors such as negotiations, due diligence, and the involvement of legal professionals can all affect this timeline.

What happens after the agreement is signed?

Once the Business Purchase and Sale Agreement is signed by both parties, the next steps typically involve the transfer of ownership and any funds agreed upon. This may include the closing process, where final documents are executed, and any necessary payments are made. Following the completion of the sale, the buyer and seller should ensure that all the agreed terms are fulfilled and that any legal filings, if necessary, are completed.

Can the Business Purchase and Sale Agreement be amended?

Yes, the agreement can be amended if both parties agree to the changes and document them properly. Amendments to the contract may occur due to changes in circumstances, negotiations, or new information that comes to light. It is crucial that any amendments are made in writing to ensure clarity and maintain a record of the changes agreed upon by both parties.

What should I do if a dispute arises regarding the agreement?

If a dispute arises concerning the Business Purchase and Sale Agreement, the first step is typically to review the terms of the contract to understand each party's rights and obligations. Open communication can often resolve issues amicably. However, if this approach does not yield a satisfactory resolution, seeking legal advice or mediation may be necessary to address the dispute effectively and efficiently.