What is a Business Credit Application form?

A Business Credit Application form is a document used by businesses to apply for credit from suppliers or lenders. It helps these entities gather essential information about your business, including its financial health, credit history, and ownership details. This information allows them to assess your eligibility for credit and determine how much credit they can extend.

Who needs to fill out the Business Credit Application form?

If you are a business seeking credit terms from suppliers or lenders, you will need to complete this application. It’s typically required by wholesalers, manufacturers, and financing institutions. Whether you run a small startup or a larger business, if you want to establish credit, this form is often necessary.

What information will I need to provide?

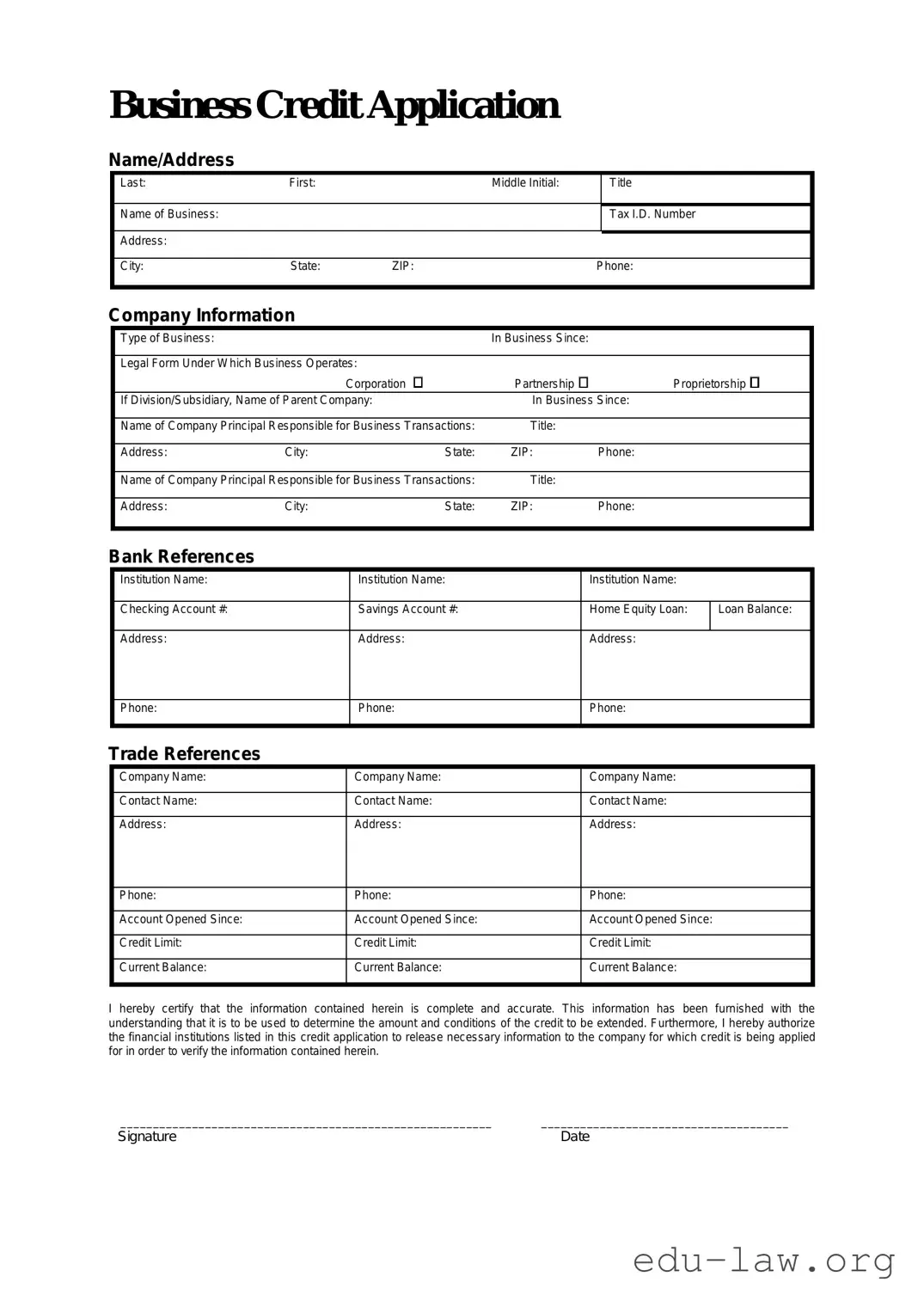

You’ll typically need to supply details such as your business name and address, contact information, ownership structure (like LLC or corporation), tax identification number, and bank references. You may also be asked about your business’s financial status, including annual revenue and outstanding debts.

How long does it take to complete the form?

The time it takes to fill out the Business Credit Application will vary. Generally, it can take anywhere from a few minutes to an hour, depending on how prepared you are. Gather your financial documentation and business details in advance to streamline the process.

How is the information evaluated?

The information you provide will be evaluated by the supplier or lender, who will look at your business's creditworthiness. They may check your business credit score and consider your payment history with other vendors. This evaluation helps them decide whether to approve your application and what credit limit to set.

Can I apply for credit if my business is new?

Yes, new businesses can apply for credit, but it may be more challenging. Lenders and suppliers often require a personal guarantee or collateral to secure the credit. They may also look at your personal credit history if your business doesn’t have an established credit profile yet.

Is there a fee to submit the Business Credit Application?

Submitting the Business Credit Application is usually free. However, some lenders or suppliers may charge fees for processing or for running a credit check. It’s always wise to ask about any associated costs prior to submitting your application.

What happens after I submit the form?

Once you submit the Business Credit Application, the supplier or lender will review it. This process might take a few days to several weeks. They will contact you with their decision, which may include approval terms, a credit limit, or requests for additional information.