What is a Business Bill of Sale?

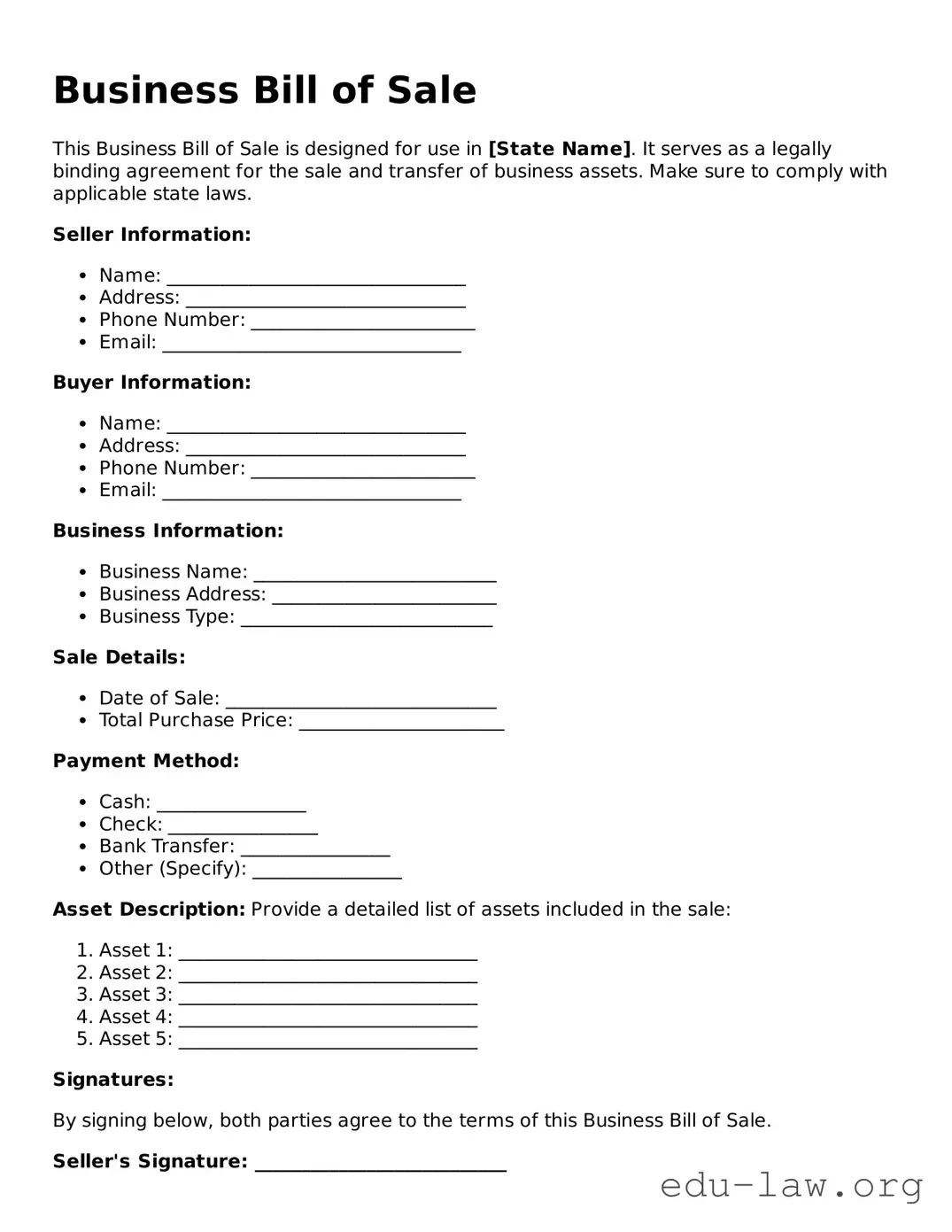

A Business Bill of Sale is a legal document that records the sale of a business or its assets from one party to another. It serves as a receipt and proof of the transaction, outlining the terms agreed upon by both the buyer and the seller.

Why do I need a Business Bill of Sale?

Having a Business Bill of Sale creates a clear record of the transaction. It protects both parties by detailing what was sold, the sale price, and any other agreements made. This document can be essential if disputes arise in the future or for tax records.

What should be included in a Business Bill of Sale?

The document should include the names and contact information of the buyer and seller, a detailed description of the business or assets being sold, the purchase price, payment terms, and the date of sale. Additional clauses regarding warranties or liabilities may also be included based on the deal.

Is a Business Bill of Sale legally binding?

Yes, a properly executed Business Bill of Sale is legally binding. It demonstrates that both parties have agreed to the terms listed in the document. For the best protection, both parties should sign the document and retain copies for their records.

Do I need to have the Business Bill of Sale notarized?

Notarization is not always required, but it can add an extra layer of protection. A notary public verifies identities and can witness the signing of the document, helping to prevent disputes over authenticity in the future.

Can I customize a Business Bill of Sale?

Absolutely. While there are standard templates available, it’s advisable to customize the document to fit your specific transaction. Tailoring it to your needs can ensure all important details are addressed appropriately.

Where can I obtain a Business Bill of Sale template?

Templates for a Business Bill of Sale can be found online through various legal websites, or you can consult with a legal professional for a customized document. Ensure that any template you choose complies with your state's laws.