What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is an assessment performed by a licensed real estate broker or agent to estimate the value of a property. It is frequently utilized for various purposes, including real estate transactions and determining a property’s suitability for loans or investments. Unlike an official appraisal, a BPO is generally quicker and less expensive, making it a popular choice for lenders, investors, and homeowners looking to sell.

Why would I need a Broker Price Opinion?

A BPO can be beneficial in several situations. For lenders, it helps evaluate collateral when a borrower requests a loan. Homeowners may seek a BPO to better understand their home’s market value before listing it for sale. Investors often use it to assess potential purchases. In summary, a BPO can provide insight into whether a property is fairly priced in the current market.

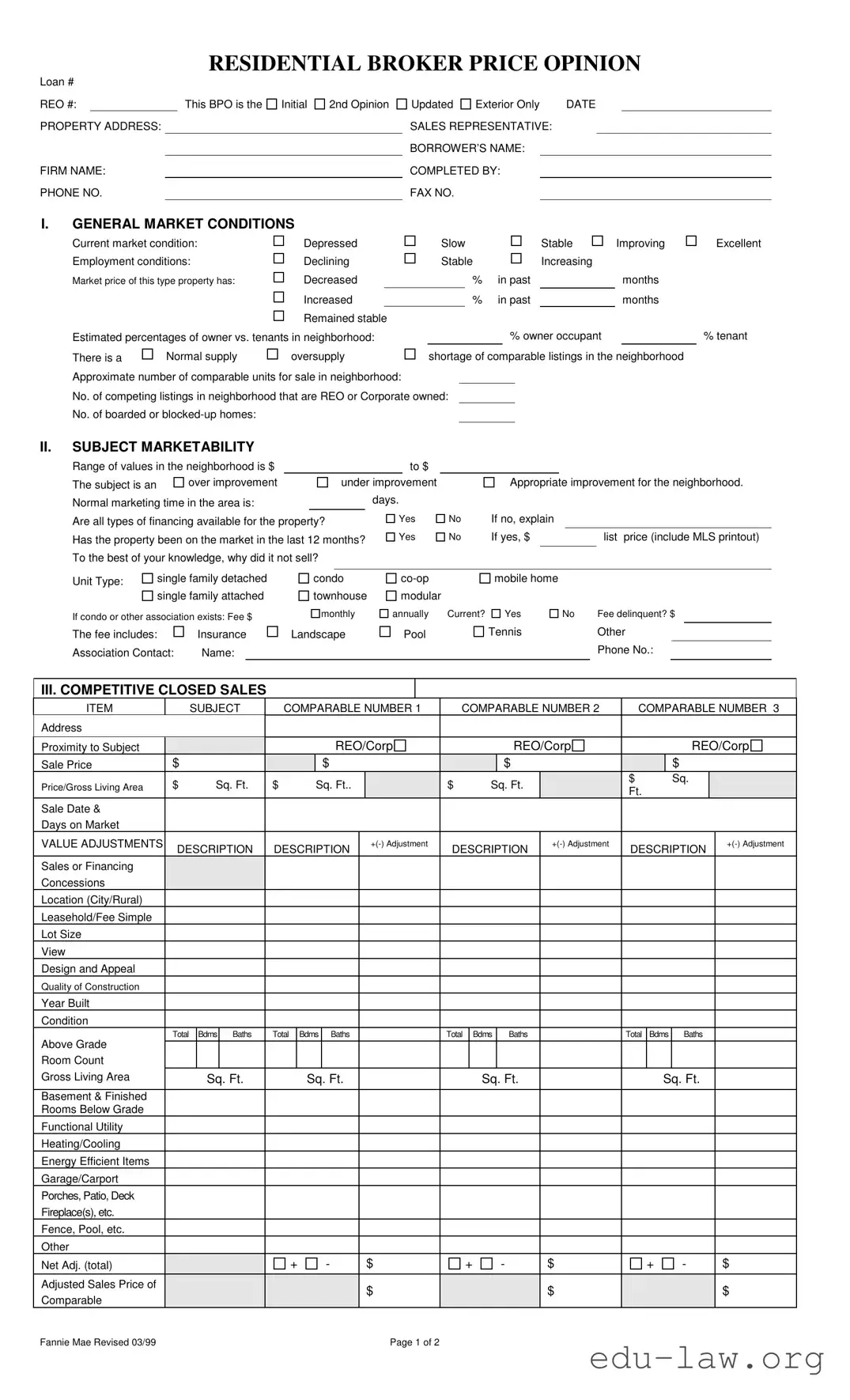

What information is included in a Broker Price Opinion?

A BPO typically includes details on the property being assessed, current market conditions, past sales data for comparable properties, and marketing strategies. The broker will evaluate things like the property's physical condition, its location, and amenities. The form captures essential quantitative data, along with qualitative insights to arrive at a value conclusion.

Who performs a Broker Price Opinion?

A Broker Price Opinion is performed by licensed real estate professionals who are knowledgeable about the specific market where the property is located. They utilize their expertise, along with available data, to provide an accurate and informed opinion on the property's value. It’s crucial that the broker is familiar with the local market trends to ensure the BPO's reliability.

How long does it take to complete a Broker Price Opinion?

The timeframe to complete a BPO can vary, but it generally takes a few days. Factors affecting this timeline include the broker's familiarity with the area, the complexity of the property, and the amount of data available. Lenders and homeowners usually appreciate the quick turnaround, especially when timely decisions are necessary.

Is a Broker Price Opinion the same as an appraisal?

No, a BPO and an appraisal serve different purposes and involve different processes. An appraisal is a formal report conducted by a licensed appraiser and adheres to stricter guidelines. While a BPO offers a broker’s opinion based on market conditions and comparable sales, an appraisal provides a detailed valuation that is typically required for mortgage loans. Both can be valuable, but they should not be confused with one another.

What are the costs associated with getting a Broker Price Opinion?

The cost of a BPO can vary depending on the broker's fees and the complexity of the property involved. Generally, a BPO is more affordable than an appraisal, with costs typically ranging from $50 to a few hundred dollars. It's a wise idea to inquire about fees upfront to ensure that there are no surprises later on.

Can I challenge the Broker Price Opinion if I disagree with it?

You have the option to challenge a BPO by providing additional information or context that you believe warrants a reevaluation. If you think that the broker overlooked key aspects of your property or market, present your evidence clearly. While brokers typically adhere to market data, they may adjust their opinion if compelling evidence is provided.

How do I find a qualified real estate broker for a Broker Price Opinion?

To find a qualified broker, start by seeking referrals from trusted friends or colleagues. Online reviews can also be helpful in identifying experienced professionals. It’s important to choose someone who specializes in your property type and has a track record of performing BPOs in your area. Verify their licenses and credentials to ensure you’re working with a reputable expert.

Unknown

Unknown

Investor

Investor