What is the Authorization and Direction Pay form?

The Authorization and Direction Pay form is a document that allows an insurance company to pay a designated body shop or repair facility directly for vehicle repairs resulting from an accident. By signing this form, you authorize the insurance provider to settle the claim on your behalf with a specific amount for services rendered.

Who should fill out this form?

This form should be filled out by the vehicle owner or claimant who has sustained damage and is seeking repairs. It’s essential for anyone looking to authorize payment directly to their chosen repair facility.

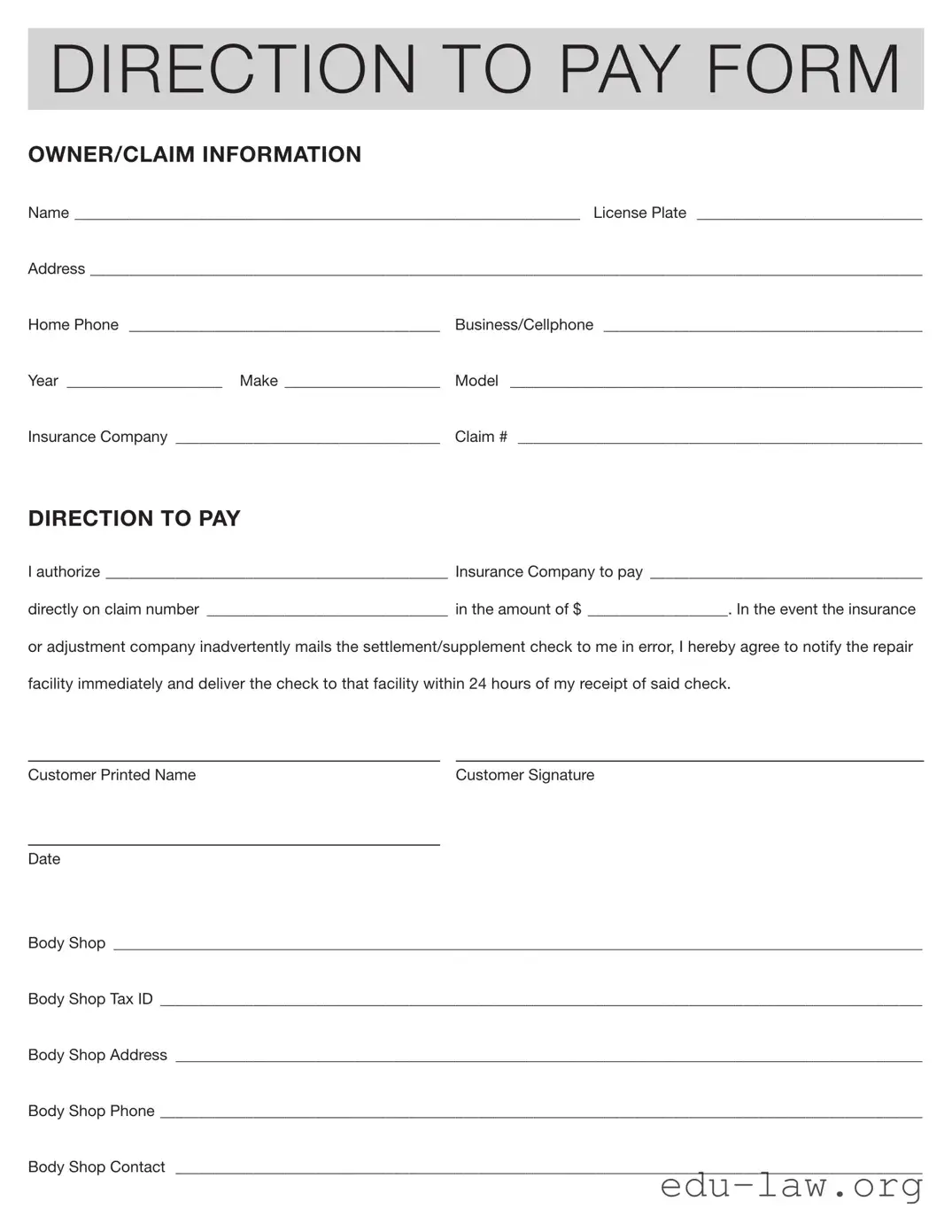

What information is required on the form?

The form requires several pieces of information: your name, address, contact numbers, vehicle details (including license plate, year, make, and model), and your insurance company details. Additionally, you will need to specify the claim number and the amount you authorize to be paid directly to the repair facility.

How does the Directing Pay process work?

Once you complete the form, you submit it to your insurance company. Upon processing, the insurance company will pay the specified amount directly to the body shop for repairs. This simplifies the financial transaction and can expedite the repair process.

What happens if I receive a check from the insurance company?

If the insurance company mistakenly sends the settlement or supplement check to you instead of the repair facility, you must notify the repair shop immediately. You must deliver the check to the body shop within 24 hours of receiving it to ensure the timely completion of repairs.

Is it necessary to involve the body shop in this process?

Your body shop should be aware of your intention to authorize their payment. They often assist in completing the form and may provide guidance on how much to authorize based on the repairs needed. Communication with the body shop ensures a smooth transaction and helps avoid any conflicts later.

Can I specify a different amount than what the insurance adjuster estimated?

Yes, you can specify a different payment amount on the form, as long as it is agreed upon by both you and the repair facility. However, it’s advisable to discuss any discrepancies with both your insurance adjuster and the body shop to avoid delays in processing.

Do I have to pay for repairs up front if I use this form?

Typically, using this form allows the body shop to receive direct payment from your insurance company, meaning you may not need to pay out of pocket initially. However, you should confirm this with your repair facility, as some may require a deposit or partial payment depending on their policies.

What if I change my mind after signing the form?

If you change your mind after signing the Authorization and Direction Pay form, notify your insurance company and the repair facility immediately. However, it’s important to understand the implications of canceling any authorizations, as it may impact the status of your claim or repairs already in progress.

Where can I obtain this form?

You can typically obtain the Authorization and Direction Pay form from your insurance company’s website, through your insurance agent, or directly from the repair facility. It’s always a good idea to check with your insurance provider for any specific requirements or additional documentation needed.