The Articles of Incorporation serve as a foundational document for forming a corporation, similar in purpose to a Business License. While the Articles create the corporation legally, the Business License allows it to operate within a specific jurisdiction. This license ensures compliance with local regulations and signifies that the business has met the certain standards required for legal operation. Ultimately, both documents affirm the legitimacy and official recognition of the entity in the eyes of the law.

Another important document is the Bylaws. Unlike the Articles of Incorporation, which focus on establishing the corporation, Bylaws outline the internal rules and procedures that govern the corporation's operations. They detail aspects such as shareholder meetings, board of director responsibilities, and voting processes. Together, these documents facilitate structured governance and clarify the relationship between stakeholders.

The Operating Agreement is particularly relevant for Limited Liability Companies (LLCs), sharing some similarities with the Bylaws. An Operating Agreement defines the management structure and operating procedures of the LLC, detailing the rights and responsibilities of members. Like Bylaws for corporations, this agreement enhances clarity among members concerning operational and financial decisions.

Business Partnership Agreements come into play when a corporation is established involving multiple stakeholders. This agreement defines the terms under which partners operate, including profit-sharing, responsibilities, and dispute resolution. While the Articles of Incorporation denote a formal business entity, a Partnership Agreement focuses on interpersonal relations and governance among the partners.

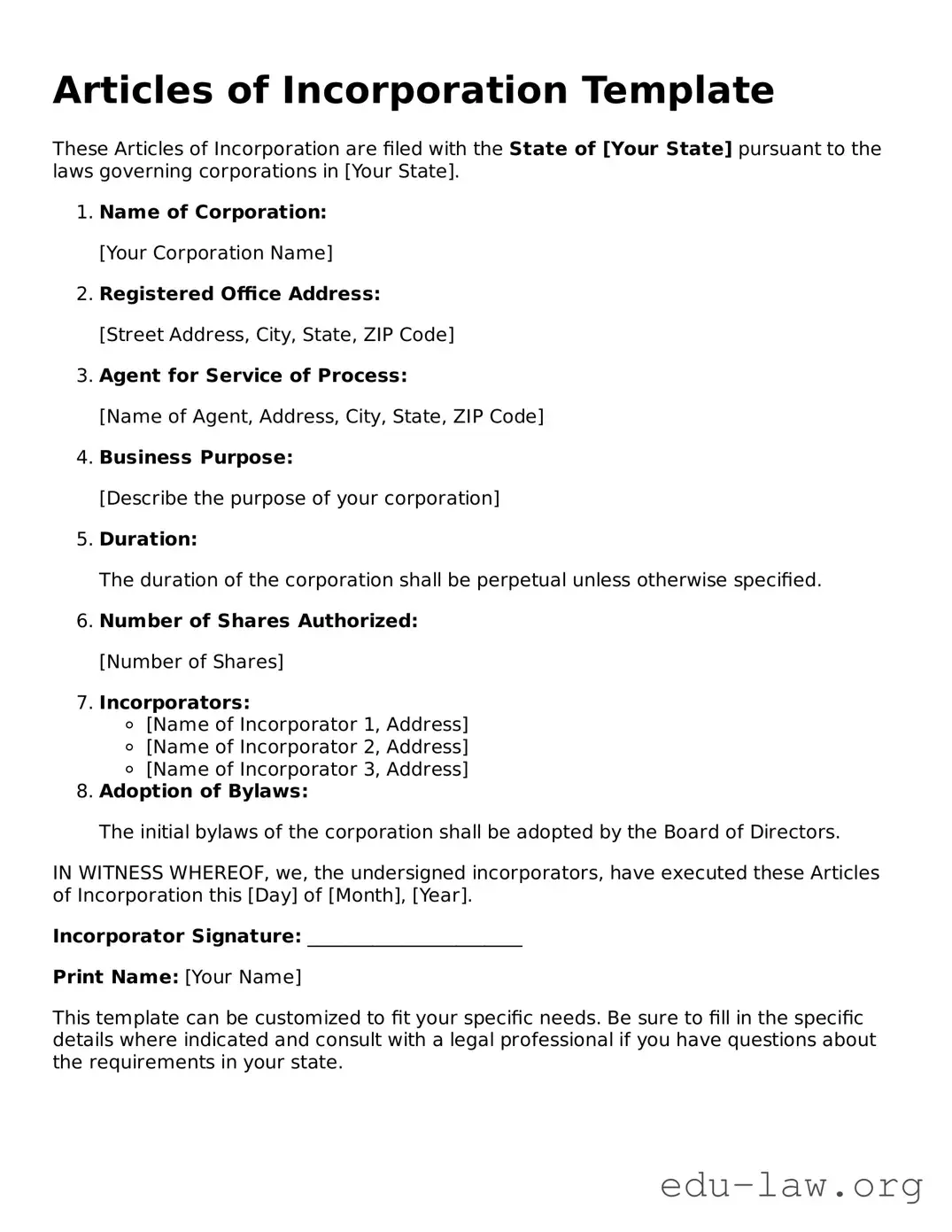

Certificates of Incorporation are akin to the Articles of Incorporation in purpose, as they verify the existence of a corporation. In various states, these terms may be used interchangeably. The Certificate of Incorporation is filed with the state government, providing essential information such as the corporation's name, business purpose, and registered agent. It serves as formal proof of incorporation upon approval.

Like the Articles of Incorporation, the Statement of Information is often a subsequent filing required by states. This document provides updated information regarding the corporation, such as its principal business address and details about its officers. While the Articles represent the initial establishment of the corporation, the Statement of Information ensures ongoing compliance by keeping key details current.

Shareholder Agreements also hold a significance that resonates with the foundational role of Articles of Incorporation. These agreements outline the rights and obligations of shareholders within the corporation, addressing crucial topics like share transfers and voting rights. Establishing clear expectations among shareholders is vital for compliance with corporate governance, much like the Articles would outline the company's basic structure.

The Nonprofit Incorporation Application bears similarity to the Articles of Incorporation in that it formalizes a nonprofit organization. This application provides necessary information about the nonprofit's purpose, structure, and board of directors. Like its business counterpart, it marks the organization’s legal establishment and is a crucial step toward gaining tax-exempt status.