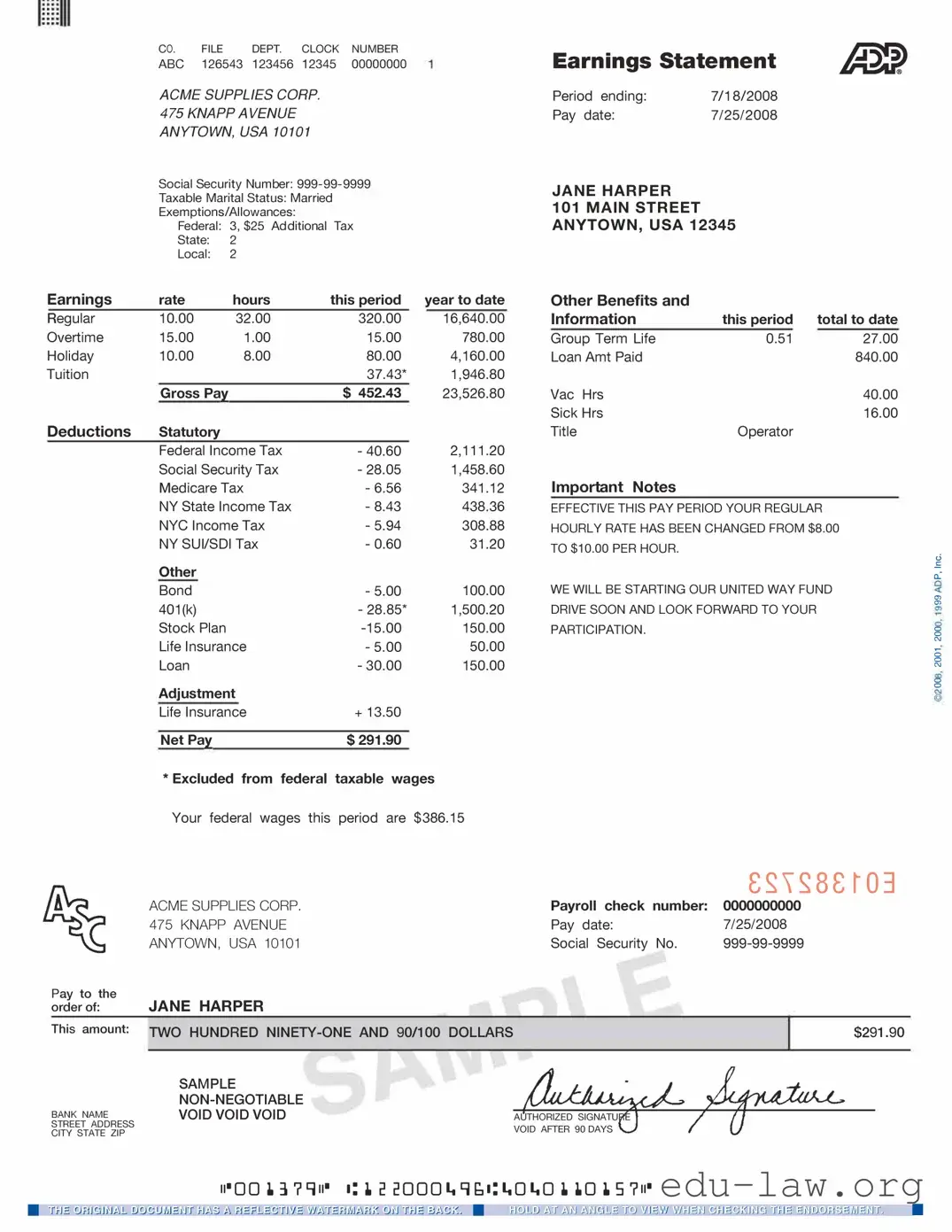

The ADP Pay Stub form plays a crucial role in providing detailed insights into employee compensation, deductions, and various benefits. Employees rely on this document to understand their earnings for a specific pay period, which can include hourly wages, salaries, overtime pay, and bonuses. Furthermore, the pay stub outlines deductions that might encompass federal and state taxes, Social Security, Medicare, and any other contributions, such as retirement plans or health insurance premiums. By breaking down each component of the paycheck, the form helps employees track their financial records and ensure that the payments received align with their expectations. For employers, using the ADP Pay Stub form fosters transparency and simplifies payroll management, ultimately supporting a clear communication channel between them and their staff regarding financial matters. Understanding how to interpret this form can empower employees and enhance their financial literacy, making it an essential tool in the workplace.